Mission

The Group has firmly established a clear set of policies to ascertain fairness in all operations and ensure that all activities are carried out in the best interest of its shareholders.

Corporate Governance Report (Extracted from 2023 Annual Report dated 26 March 2024)

Corporate Governance Practices

The board of directors ("Board" or "Directors") of Shun Tak Holdings Limited (the "Company") is committed to principles of good corporate governance standards and procedures. This report describes the Company's efforts to apply the principles and comply with the provisions in the Corporate Governance Code (the "CG Code") as set out in Appendix C1 of the Rules Governing the Listing of Securities (the "Listing Rules") on The Stock Exchange of Hong Kong Limited (the "Stock Exchange").

The Company is committed to maintaining high standards of corporate governance and fostering sustainable business growth and development. To oversee the Group's strategies and development of corporate sustainability, the executive committee ("Executive Committee") was delegated by the Board to establish a sustainability steering committee ("Sustainability Steering Committee") which is responsible for formulating the Group's sustainability vision, strategy and policy, monitoring and reviewing environmental, social and governance ("ESG") related goals and targets, evaluating the impact of initiatives and measuring the performance, and giving advice on the implementation progress of ESG goals and targets. The Sustainability Steering Committee reports to the Board through the Executive Committee on the Company's ESG issues on a regular basis. In 2014, the Executive Committee adopted a sustainability policy ("Sustainability Policy") to demonstrate the Company's commitment to sustainable business growth and development through adoption of sound ESG approaches and the Company has published its annual sustainability reports since then.

The Listing Rules require every listed company to report how it applies the principles in the CG Code and to confirm that it complies with such provisions, or provide an explanation if it does not. The Board periodically reviews the Company's practices to ensure compliance with increasingly stringent requirements and to meet rising expectations of its shareholders ("Shareholders"). A corporate governance policy (the "CG Policy") outlining the Company's governance framework and practices was adopted by the Board in 2012 and updated in August 2017.

The Board is of the opinion that the Company has complied with the CG Code provisions throughout the year ended 31 December 2023, except for Code provision C.2.1, which requires the roles of Chairman and Chief Executive to be separate and not to be performed by the same individual. The Board is of the view that since all major decisions have been made in discussion among Board members and appropriate Board committees ("Board Committee"), the allocation of power and authority within the corporate structure is adequately balanced to satisfy the objective of this Code provision. In addition, there are four independent non-executive Directors ("INEDs") on the Board who offer their respective experience, expertise, and independent advice and views from different perspectives. Therefore, it is in the best interest of the Company that Ms. Pansy Ho, with her in-depth knowledge of the businesses and extensive experience in the operations of the Company and its subsidiaries (the "Group"), assumes her dual capacity.

Model Code for Securities Transactions

Code provision C.1.3 requires directors to comply with the Model Code for Securities Transactions by Directors of Listed Issuers in Appendix C3 of the Listing Rules (the "Model Code").

The Model Code was adopted by the Company as its own code for Directors' securities transactions. All Directors expressly confirmed that they had fully complied with the Model Code during the year ended 31 December 2023.

THE BOARD

Corporate Culture

The Group positions itself as a cross-sector, cross-regional conglomerate in the Guangdong-Hong Kong-Macau Greater Bay Area with a strong heritage and boundless potentials. The Group creates sustainable communities by connecting families, businesses and other stakeholders with dedication and foresight.

The Group's origin dates back to 1962 with the inauguration of a passenger ferry service between Hong Kong and Macau. Since the Company was established in 1972, it has been recognised as a leading player in the property, hospitality and tourism, and transportation sectors through continued creating shared value for and nurturing a cordial relationship with its stakeholders and the community.

As a responsible corporate citizen, the Group is committed to playing an instrumental role in maintaining and supporting sustainable development. A healthy corporate culture across the Group is vital for the Group to achieve its vision and mission towards sustainable growth. The Board plays a leading role in defining the purpose, values, strategic direction, and risk appetite of the Group and in fostering a culture that is building a long-term sustainable business where every customer, partner, investor, supplier and employee can benefit in the shared value of business success.

The desired culture is developed and reflected consistently in the operating practices and workplace policies of the Group, as well as relations with Shareholders and other stakeholders. The measures used for assessing and monitoring the corporate culture of the Group, including but not limited to, employee engagement, retention and training, financial reporting, whistleblowing mechanism, risk management, data privacy and security and regulatory compliance (including compliance with the Code of Conduct and other operating policies of the Group), staff safety and wellness, as well as audit and assurance.

Corporate Strategy

With "Tourism +" as its growth strategy, the Group strives to harness its diverse expertise in property, hospitality, transportation, infrastructure and investments in order to deliver cultural and economic value for places which it set foot on and contribute to the country's development.

The Board, together with senior management, set the tone and shape the corporate culture and strategic direction of the Group, which is underpinned by the core values of acting lawfully, ethically and responsibly across all levels of the Group. The Board also creates a culture of attaining high standards of corporate governance and maintaining robust corporate governance practices for the interest of Shareholders and other stakeholders.

Aligning the corporate culture with its purpose, values and strategy, the Board believes that the Group would be a trusted partner of choice.

Board Composition

The key principles of good governance require the Company to have an effective Board with collective responsibility for its success, values and enhancement of Shareholders' value. Non-executive Directors have particular responsibilities to oversee the Company's development, scrutinise its management performance, and advise on critical business issues. The Board is satisfied that it has met these requirements.

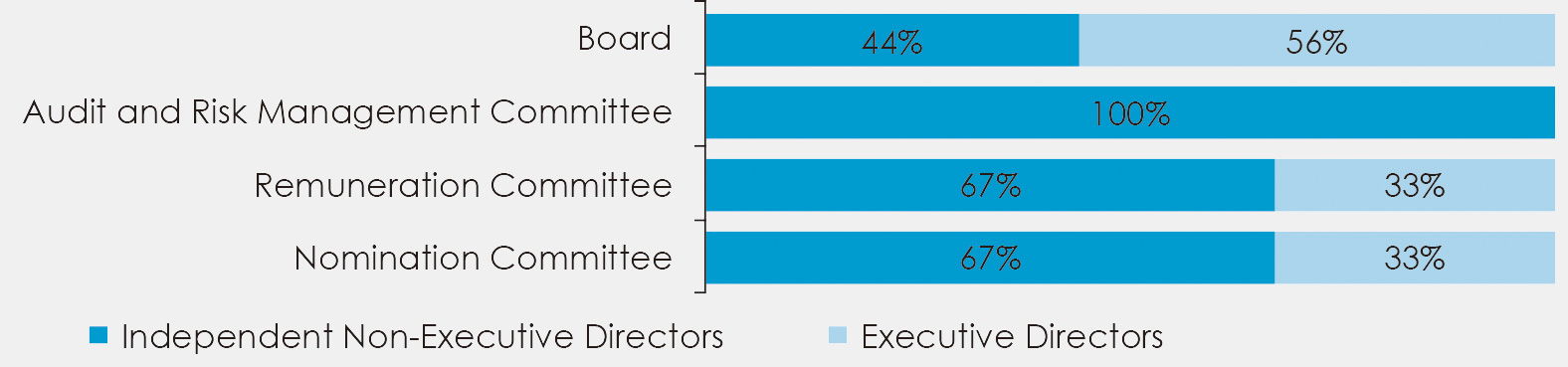

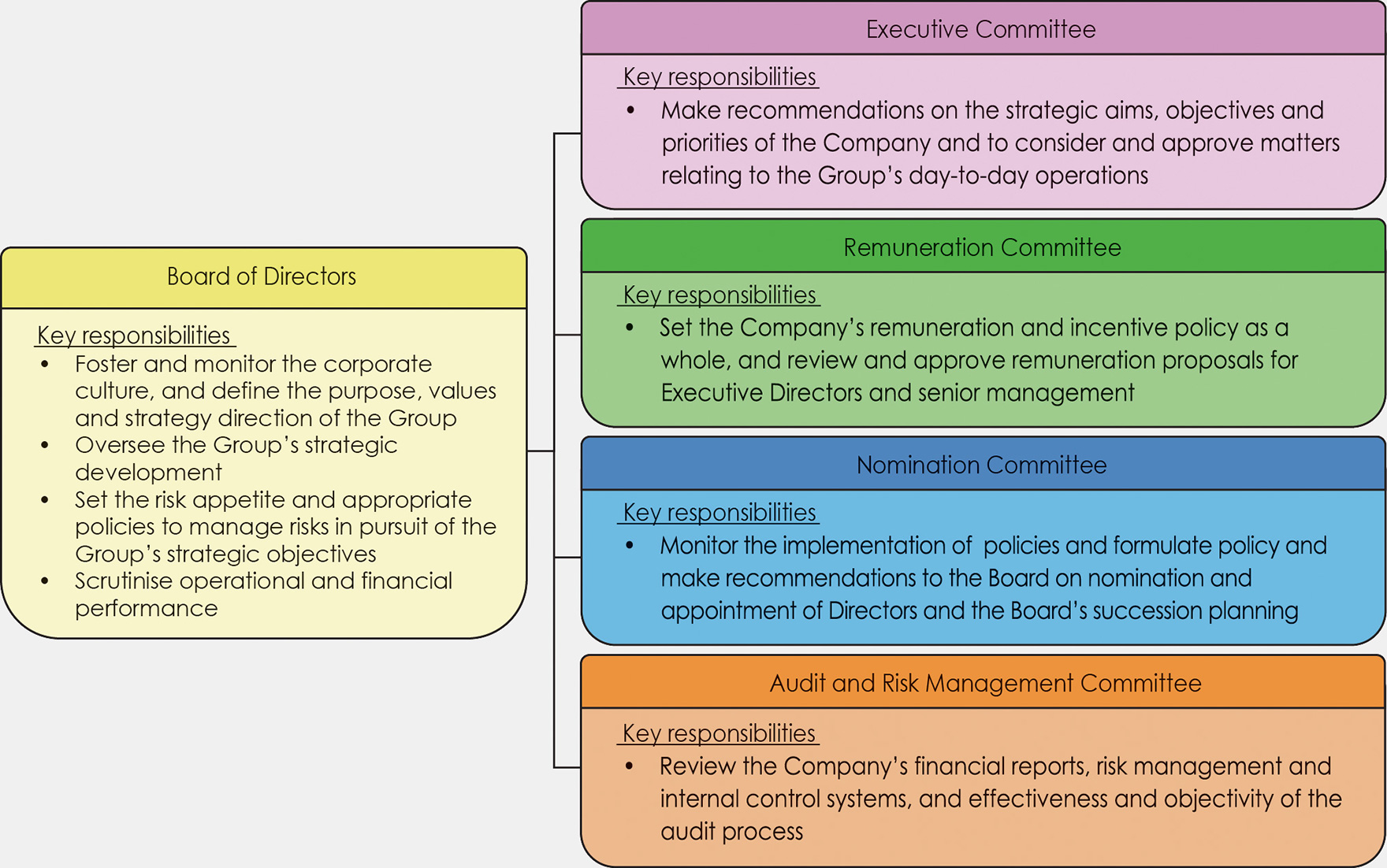

The Company has a balanced Board of Executive Directors and INEDs so that no individual or small group can dominate its decision-making process. To help the Board perform its duties and make decisions on the Company's affairs, Board Committees (including Executive Committee, remuneration committee ("Remuneration Committee"), nomination committee ("Nomination Committee") and audit and risk management committee ("Audit and Risk Management Committee")) have been established under the Company's Articles of Association ("Articles"). Other Board Committees may be formed from time to time. Further details about Board Committees are discussed in the latter part of this report.

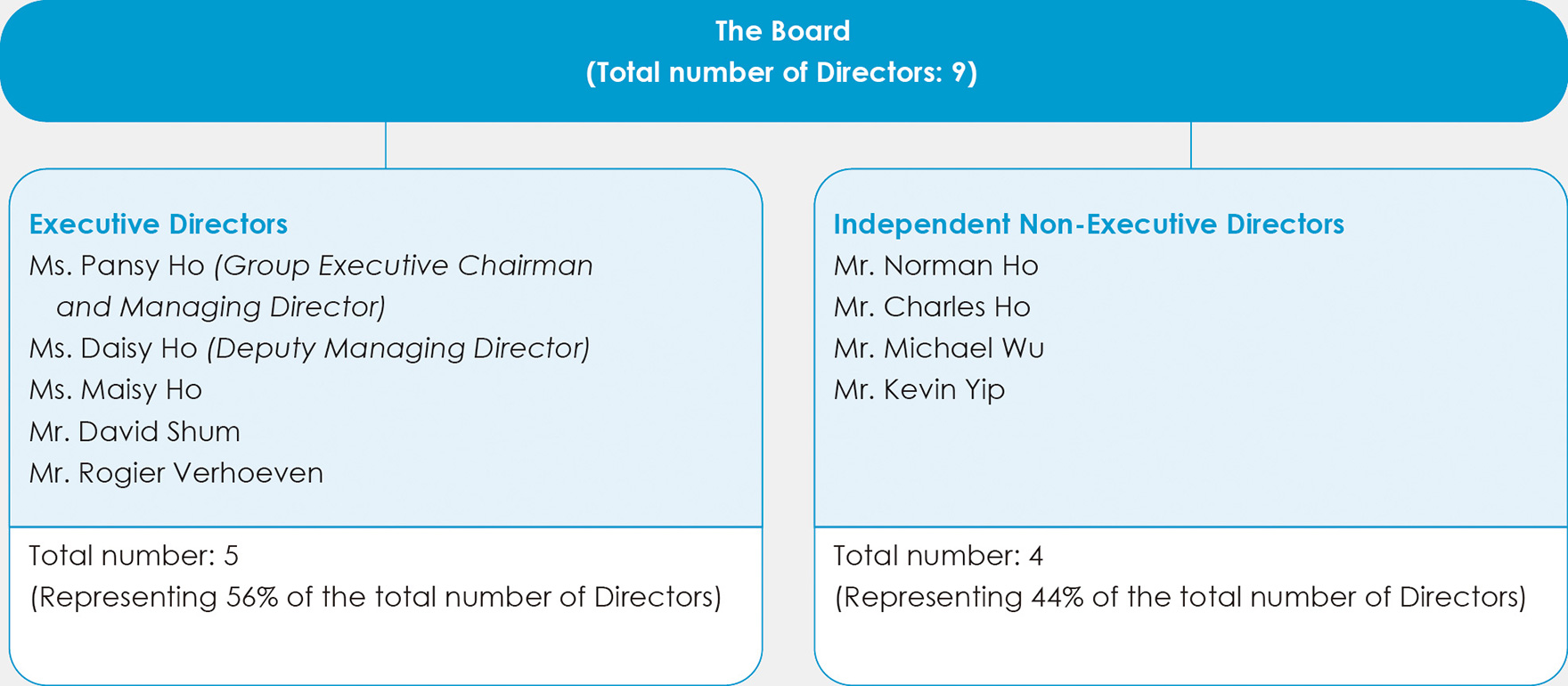

As at the date of this report, the Board has 9 members and its composition is as follows:

Brief biographies of Directors are set out in "Management Profile" in this annual report.

Board Independence

The Company has four INEDs who comprise more than one-third of the Board. Two INEDs possess professional accounting qualifications. The Company received a confirmation from each of the INEDs confirming independence under Rule 3.13 of the Listing Rules.

The Nomination Committee noted that Mr. Norman Ho (an INED of the Company) is an independent non-executive director of SJM Holdings Limited (stock code: 880) ("SJM Holdings") in which (i) Ms. Daisy Ho (an executive Director and Deputy Managing Director of the Company) is the chairman and an executive director and (ii) Mr. David Shum (an executive Director of the Company) is an executive director. Taking into consideration his role as an INED of the two companies without holding any shares in the two companies, the Nomination Committee does not consider that such cross-directorship relationship will affect Mr. Norman Ho in performing his duties as an INED. The Board and the Nomination Committee have assessed his independence in light of these circumstances, including (i) his background, experience, achievements and character, and (ii) the nature of the Company's relationship with SJM Holdings and his roles, and concluded that his independence would not be affected. It was decided that potential conflicts, which are minimal, could be managed and that the benefits of his appointment outweigh any risk of conflict. The Nomination Committee is of the view that all INEDs are independent under the Listing Rules criteria.

Ms. Pansy Ho, as the Group Executive Chairman and Managing Director of the Company, is mainly responsible for Board leadership and overall performance of the Group.

The Board is responsible for fostering and monitoring the corporate culture, defining the purpose, values and strategy direction, overseeing the Group's strategic development, setting the risk appetite and appropriate policies to manage risks in pursuit of the Group's strategic objectives, and scrutinising operational and financial performance to ensure they align with the desired culture.

Management is delegated by the Board for carrying out the Group's day-to-day operations. The Group Executive Chairman and Managing Director together with the Deputy Managing Director, working with other Executive Directors and the executive management team, are responsible for managing the Group's businesses; formulating policies for Board consideration; carrying out strategies adopted by the Board; making recommendations on strategic planning, operating plans, major projects and business proposals; and assuming full accountability to the Board for the Group's operations. The Executive Directors conduct regular meetings with the management of the Group and associated companies during which operational issues and financial performance are reviewed. The Executive Directors regularly report to the Board and on an ad hoc basis when necessary.

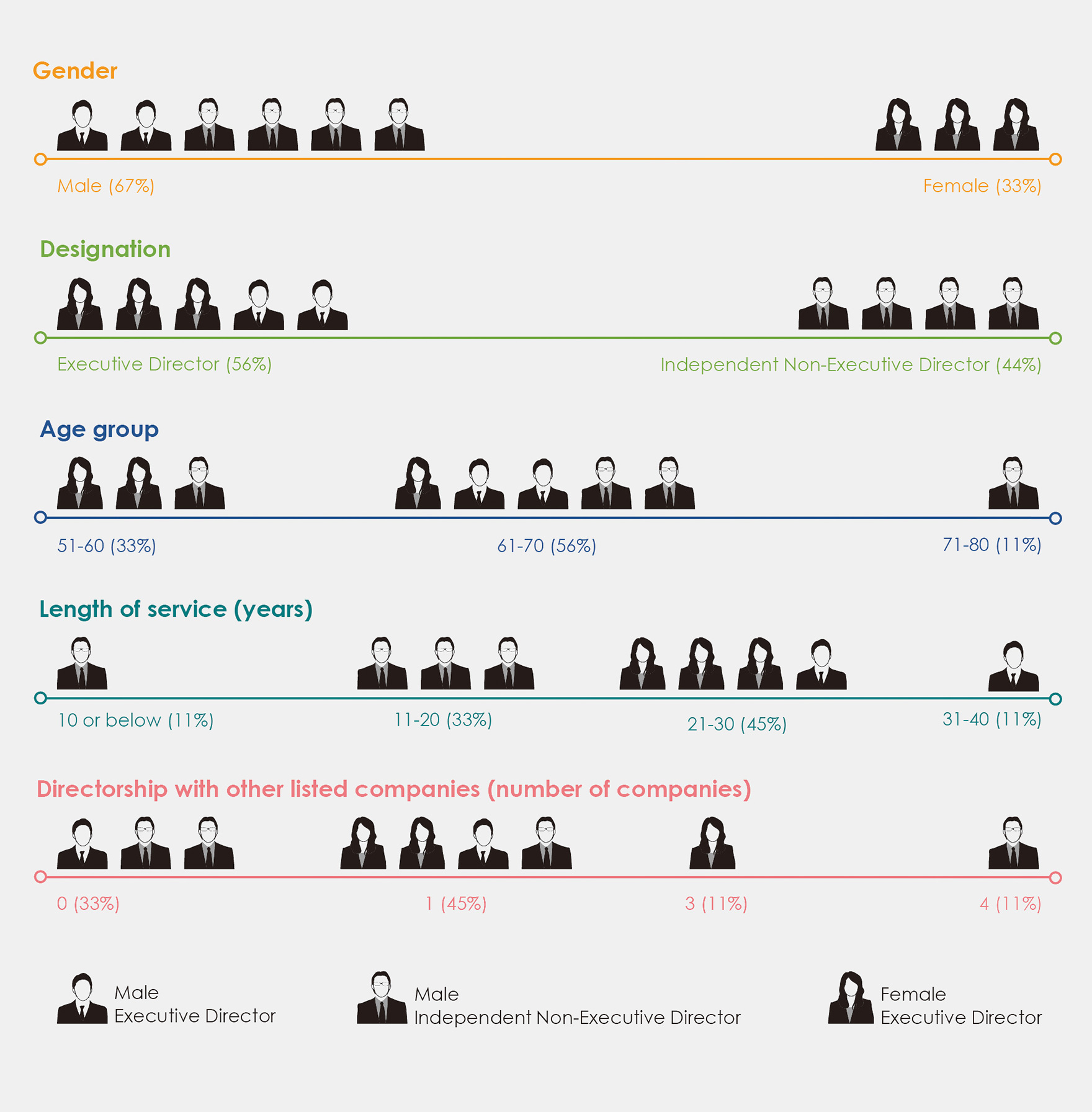

Board Diversity

In 2013, the Board adopted a board diversity policy (the "Board Diversity Policy") to achieve a diverse Board and enhance performance quality. "Diversity" would be considered from various aspects, including gender, age, cultural and educational background, professional experience, skills, knowledge and length of service, etc. Board appointments are based on merit and candidates will be assessed against objective criteria, with due regard for the benefits of diversity. The Nomination Committee will monitor implementation of the policy and, to ensure its effectiveness, it will review the policy and recommend revisions to the Board for consideration and approval, when necessary.

Board diversity is shown below. Directors' biographical details are set out in "Management Profile" in this annual report.

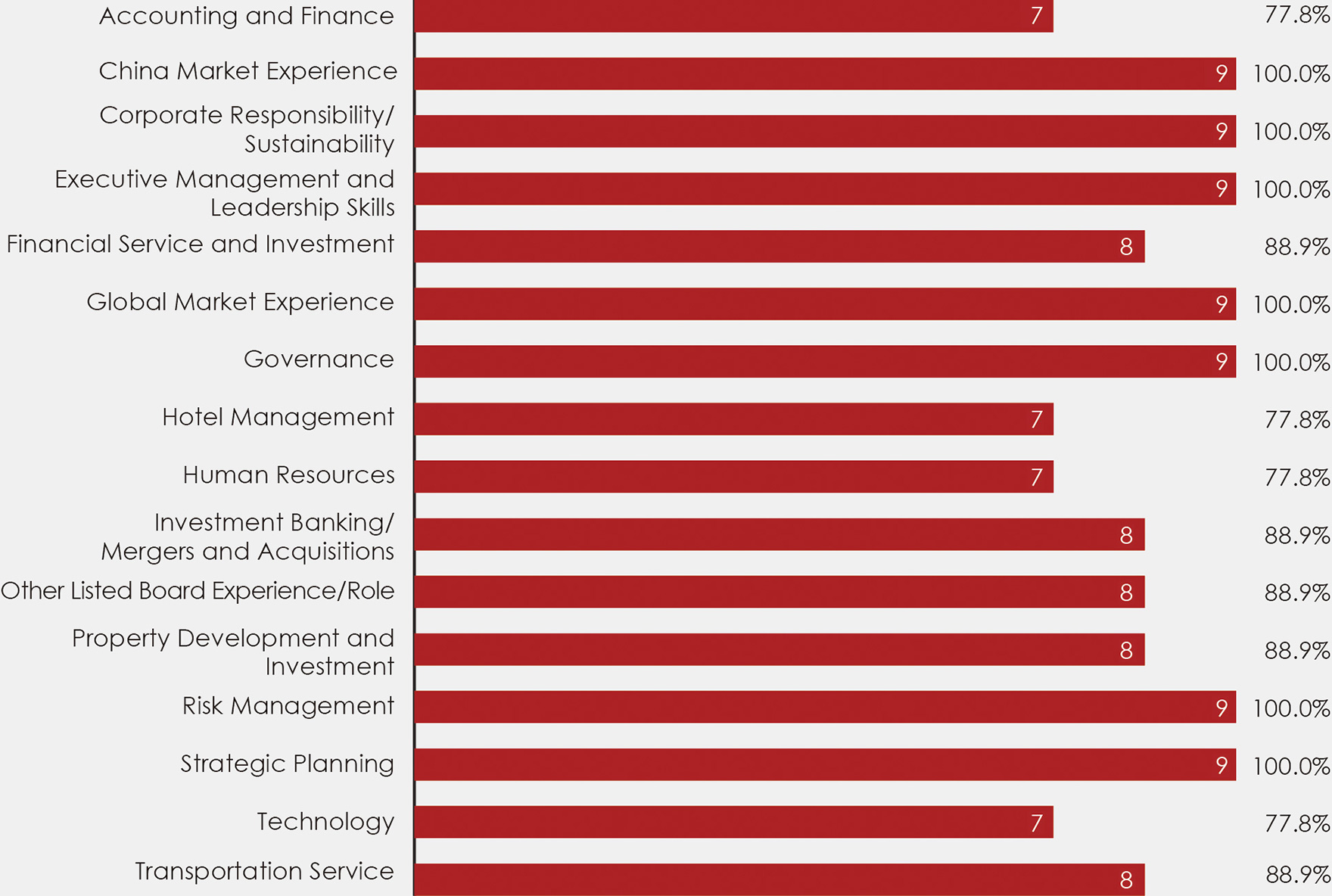

Directors are from diverse and complementary backgrounds. The valuable experience and expertise they bring to our business are critical for the long-term growth of the Company. The Nomination Committee reviewed the composition of the Board under diversified perspectives and monitored the implementation and effectiveness of the Board Diversity Policy and considered that the Board Diversity Policy is effective.

Given the fairer gender proportion on the Company's Board (67% male and 33% female) as illustrated above, the Board is satisfied that gender diversity has been achieved at Board level.

The following sets out the total workforce (including senior management) by gender of the Group as at 31 December 2023:

| Number of Employees | Percentage | |

|---|---|---|

| Male | 782 | 46% |

| Female | 931 | 54% |

The Group has made progress in past years to maintain a satisfactory gender mix. All human resources processes including recruitment, promotion, rewards and career development opportunities continue to be based on competence, knowledge, experience and merit of the employees and prospective employees, regardless of gender.

The current composition of the Board under diversified perspectives is summarised as follows:

Skills, Knowledge and Professional Experience

| Note: | The perspectives selected above have been identified as attributes of a director in alignment with the Company's nature of business. |

|---|

Board Practice

To ensure that the Board works effectively and performs its responsibilities, its members are provided with monthly updates on Company performance, financial position and prospects. Directors have full and timely access to relevant information and are properly briefed on issues considered at Board meetings. The duty of preparing the meeting agenda is delegated to the company secretary (the "Company Secretary"). Each Director may request inclusion of items on the agenda.

To make informed decisions, Directors are given information packages with explanation and analysis of agenda items not less than three days before a meeting. The Company Secretary keeps Directors informed of corporate governance issues and regulatory changes, and ensures Board procedures follow the CG Code and relevant legal requirements. The Board is provided with sufficient resources to perform its duties and, if required, an individual Director may engage independent professional advisers at the Company's expenses to provide advice on specific matters under the standard procedures adopted by the Board in 2005 (the "Mechanism").

Under the Mechanism, a Director shall give prior notice to the Company Secretary of his/her intention to seek independent professional advice and shall provide the name(s) of any independent professional advisers he/she proposes to instruct together with a brief summary of the subject matter. The Company Secretary can provide the names of suggested independent professional advisers upon request of the Director. The Company Secretary shall provide a written acknowledgment of receipt of the notification. Any advice obtained under the Mechanism shall be made available to the other members of the Board, if the Board so requests. The Mechanism is to ensure independent views and input are available to the Board under the appropriate circumstances. The Executive Committee reviewed the implementation and effectiveness of the Mechanism and considered that the Mechanism is effective.

If a Director has a conflict of interest in any matter under Board consideration, such matter will be dealt with by a physical Board meeting instead of a written resolution. Such Director shall abstain from voting, and not be counted in the quorum, for any resolution in which he or she has a material interest.

An open atmosphere exists for Directors to contribute alternative views at meeting. Major decisions are taken after full discussion. Minutes of Board and Board Committee meetings are recorded in detail with draft minutes circulated for comment before approval by Directors and Board Committee members, respectively. Minutes and written resolutions of the Board and Board Committees are kept by the Company Secretary and open for inspection by Directors. Such minutes and written resolutions are circulated to Directors at regular Board meetings.

The Company has appropriate directors' and officers' liability insurance for legal action against Directors.

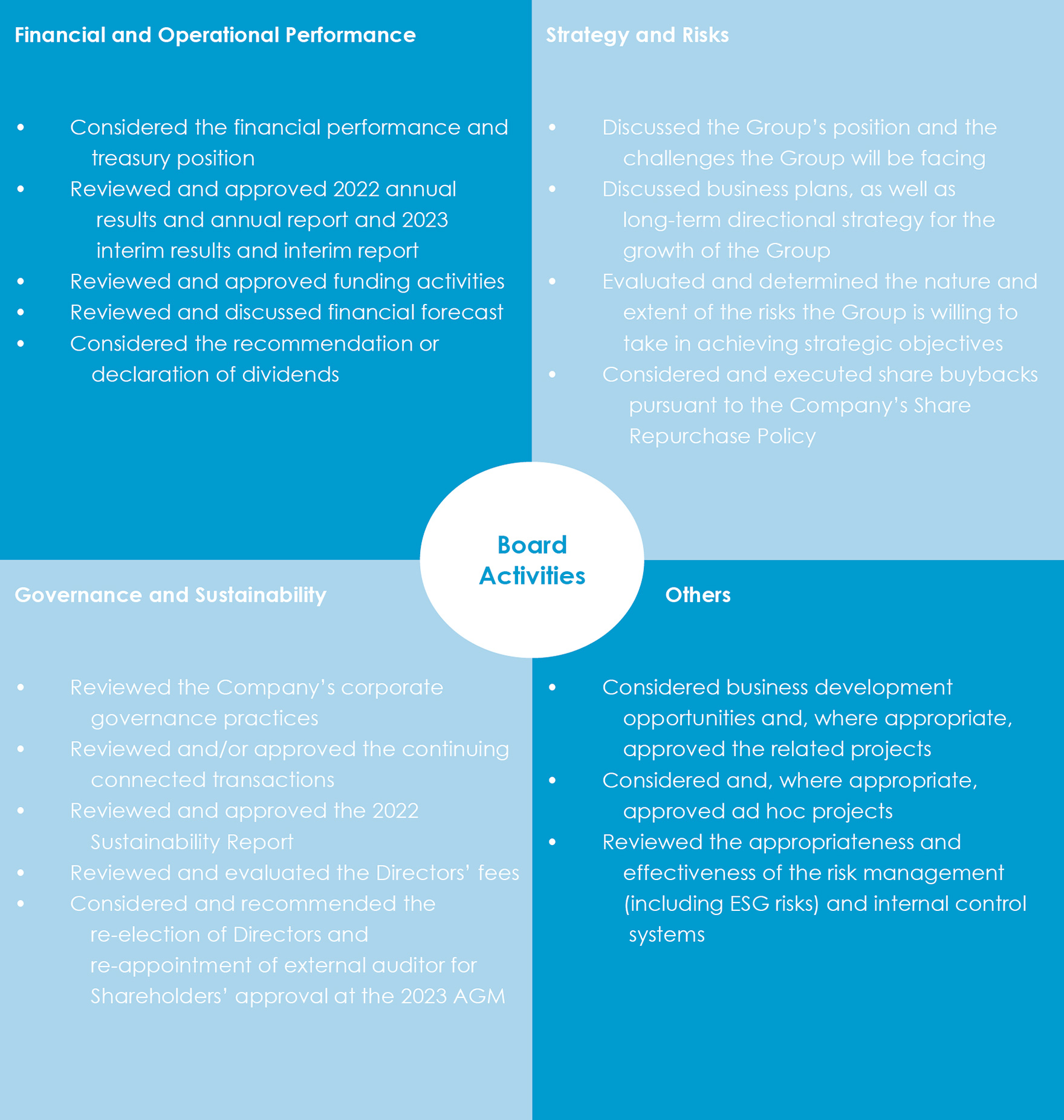

Board Activities

Board activities are structured to assist the Board in achieving its goal to support and advise management on the delivery of the Group's strategy within a transparent governance framework. The diagram below shows the key areas of focus for the Board and the main activities during 2023.

During the year, a total of four Board meetings were held primarily to review quarterly business performance and strategy in the business or other relevant areas.

Directors are expected to attend all meetings of the Board and the Board Committees on which they serve and to devote sufficient time to the Company to perform their duties. Where directors are unable to attend a meeting, they receive papers for that meeting giving them the opportunity to raise any issues with the Chairman in advance of the meeting. At each scheduled meeting, the Board receives updates from the relevant business/supporting units on the financial and operational performance of the Group and any specific developments in their areas of the businesses for which they are directly responsible and of which the Board should be aware. Chairpersons of the respective Board Committees would also report on matters discussed and/or approved at the relevant Board Committees' meetings held prior to the Board meetings.

Appointments and Re-election of Directors

All INEDs are appointed for a specific term of three years. Under the Articles, every Director, including those appointed for a specific term, is subject to retirement by rotation at least once every three years at the Company's annual general meeting ("AGM"). Any Director appointed by the Board is subject to re-election by Shareholders at the next AGM following his or her appointment. Directors who are subject to retirement and re-election at the forthcoming AGM are set out in "Report of the Directors" in this annual report.

Directors' Induction, Development and Training

Each newly-appointed Director is offered training on the Company's key areas of business operations and practices. Newly-appointed Directors are offered orientation materials that set out the duties and responsibilities of directors under the Listing Rules and relevant ordinances and regulations. Directors are provided with "A Guide on Directors' Duties" issued by the Hong Kong Companies Registry and "Guidelines for Directors" issued by Hong Kong Institute of Directors ("HKIoD") which set out the general principles of directors' duties and "Corporate Governance Guide for Boards and Directors" issued by the Stock Exchange which set out a framework and clear guidance for corporate governance disclosure, application and implementation. All INEDs are given "Guide for Independent Non-Executive Directors" issued by HKIoD.

The Company encourages Directors to participate in continuing professional training and development courses to enhance relevant knowledge and skills. The Company also updates Directors on the latest development of Listing Rules and applicable laws and regulations to facilitate awareness and ensure compliance. The Executive Committee is responsible for reviewing training and continuous professional developments of Directors and senior management. During the year, the Company had provided trainings to Directors on updates covering topics of Companies Registry's guidance note relating to good practice on holding virtual or hybrid general meetings, the Stock Exchange's guide on general meetings and disclosures of information and its consultation conclusions on proposal to expand paperless listing regime, new Singaporean Rules for property developers under the Developers (Anti-Money Laundering and Terrorism Financing) Act and INEDs' roles and responsibilities, etc. The Company had also organised a training session on ESG recent regulatory requirements.

According to training records provided by Directors, a summary of their training during the year is shown below:

| Directors | Type of Trainings |

|---|---|

| Group Executive Chairman and Managing Director | |

| Ms. Pansy Ho | A, B, C |

| Independent Non-Executive Directors | |

| Mr. Norman Ho | A, B, C |

| Mr. Charles Ho | A, B |

| Mr. Michael Wu | A, B |

| Mr. Kevin Yip | A, B, C |

| Deputy Managing Director | |

| Ms. Daisy Ho | A, B, C |

| Executive Directors | |

| Ms. Maisy Ho | A, B, C |

| Mr. David Shum | A, B, C |

| Mr. Rogier Verhoeven | A, B |

| A: | Reading materials and/or attending briefing/training session provided/organised by the Company or other corporations |

|---|---|

| B: | Access to web-based e-learning courses launched by the Stock Exchange for directors of listed companies |

| C: | Attending seminar and/or conference and/or forum |

Meeting Attendance by Directors during the year

Regular Board meetings are held at least four times every year at approximately quarterly intervals. Additional Board meetings are held if required. During the year ended 31 December 2023, the Board held four meetings, and the Group Executive Chairman and Managing Director held one meeting with INEDs without the presence of Executive Directors.

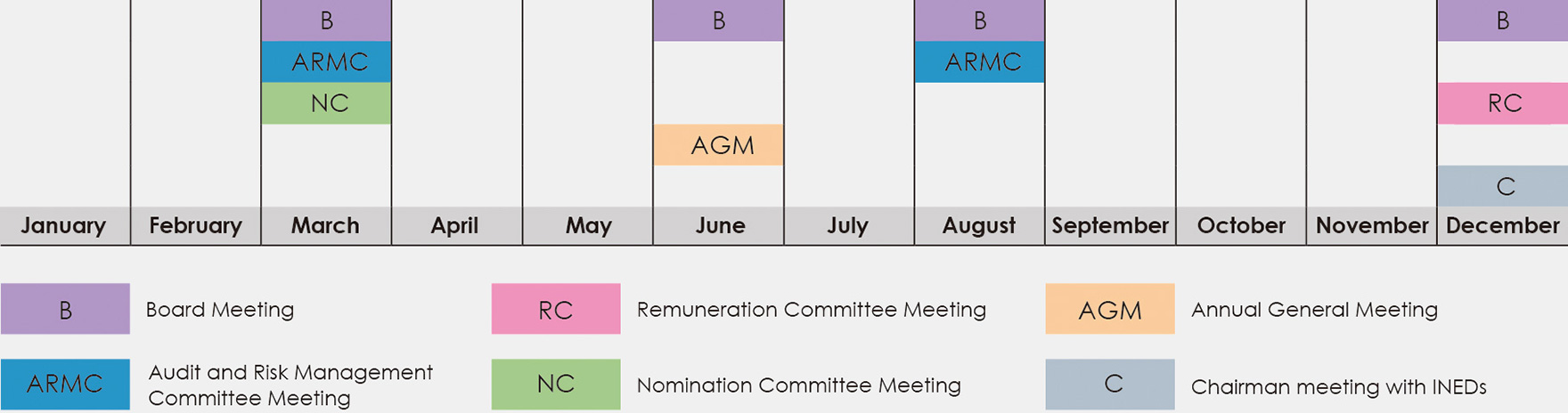

The timeline for meetings of the Board, Board Committee and Shareholders held in 2023 is set out below:

Attendance by Directors at meetings of the Board, Audit and Risk Management Committee, Remuneration Committee, Nomination Committee and 2023 AGM during the year is shown below:

| Name of Director | Board | Audit and Risk Management Committee (Note) |

Remuneration Committee | Nomination Committee | 2023 AGM (Note) |

|---|---|---|---|---|---|

| (Number of Meetings Attended/Entitled to Attend) | |||||

| Group Executive Chairman and Managing Director | |||||

| Ms. Pansy Ho | 4/4 | n/a | 1/1 | 1/1C | 1/1 |

| Independent Non-Executive Directors | |||||

| Mr. Norman Ho | 4/4 | 2/2C | 1/1 | 1/1 | 1/1 |

| Mr. Charles Ho | 3/4 | n/a | 1/1 | 1/1 | 0/1 |

| Mr. Michael Wu | 4/4 | 2/2 | 1/1C | 1/1 | 1/1 |

| Mr. Kevin Yip | 4/4 | 1/2 | 1/1 | 1/1 | 1/1 |

| Deputy Managing Director | |||||

| Ms. Daisy Ho | 4/4 | n/a | 1/1 | 1/1 | 1/1 |

| Executive Directors | |||||

| Ms. Maisy Ho | 3/4 | n/a | n/a | n/a | 1/1 |

| Mr. David Shum | 4/4 | n/a | n/a | n/a | 1/1 |

| Mr. Rogier Verhoeven | 3/4 | n/a | n/a | n/a | 1/1 |

C – Chairman of the Board Committee

| Note: | Representatives of the external auditor participated in two Audit and Risk Management Committee Meetings held in March and August 2023, and also attended the 2023 AGM. |

|---|

Board Committees

The Board has established four Board Committees, namely the Executive Committee, Remuneration Committee, Nomination Committee and Audit and Risk Management Committee, to assist it in carrying out its responsibilities.

The current composition of the Board Committees is as follows:

Each of the Board Committees has defined duties and responsibilities set out in their respective terms of reference which are no less exacting than those in the CG Code and which are regularly reviewed and updated upon regulatory changes or Board direction. Other Board Committees for dealing with ad hoc matters when necessary are delegated with specific duties and authorities by the Board. All Board Committees are provided with sufficient resources to perform their duties.

Executive Committee

Composition

The Executive Committee consists of five members, namely, Ms. Pansy Ho (Group Executive Chairman and Managing Director), Ms. Daisy Ho (Deputy Managing Director), Ms. Maisy Ho, Mr. David Shum and Mr. Rogier Verhoeven. Ms. Pansy Ho is the chairman of the Executive Committee.

Duties and Responsibilities

To operate more efficiently, the Executive Committee was established to make recommendations on the strategic aims, objectives and priorities of the Company and to consider and approve matters relating to the Group's day-to-day operations. The duties and responsibilities of the Executive Committee are set out in its terms of reference. Meetings are held as required by its work.

The Executive Committee was delegated by the Board to perform corporate governance functions set out in Code provision A.2.1 of the CG Code including:

(i)developing and reviewing the Company's policies and practices on corporate governance and making recommendations to the Board;

(ii)reviewing and monitoring training and professional development of Directors and senior management;

(iii)reviewing and monitoring the Company's policies and practices on compliance with legal and regulatory requirements;

(iv)developing, reviewing and monitoring the code of conduct and compliance manual applicable to employees and Directors; and

(v)reviewing compliance with the CG Code and disclosure in the corporate governance report.

As at the date of this report, the Executive Committee has reviewed the Company's policies and practices including:

- the Company's compliance with the CG Code and its disclosure in this report;

- Directors' participation in continuous professional development;

- the Company's Mechanism and procedures to ensure that independent views and input are available to the Board;

- CG Policy;

- Shareholders' Communication Policy;

- Dividend Policy;

- Inside Information Policy;

- Share Repurchase Policy; and

- Policies and Procedures on Risk Management.

The Executive Committee has also reviewed the results of a stakeholder engagement exercise conducted through an online stakeholder survey in 2023 and approved the adoption of new identified material topics for preparing the 2023 sustainability report.

During the year, the Executive Committee has also reviewed the composition of the Sustainability Steering Committee and approved the appointment of new committee members and has reviewed and approved contracts for the cross-border transfer of personal information of the PRC for the Group's PRC subsidiaries and/or affiliates.

In light of Code provision D.2, the Executive Committee was delegated by the Board to (i) assist the Board in evaluating and determining the nature and extent of risks the Board is willing to take to achieve the Group's strategic objectives; and (ii) oversee management in the design, implementation and ongoing monitoring of risk management (including ESG risks) and internal control systems and to ensure their appropriateness and effectiveness.

Other Board Committees

Details of the Remuneration Committee, Nomination Committee and Audit and Risk Management Committee, including their composition, duties and responsibilities, annual work summary and applicable policies are set out in the separate reports on pages 95 to 109 of this annual report.

Internal Control And Risk Management

The Board has overall responsibility for ensuring that appropriate and effective risk management and internal control systems are established and maintained. The Executive Committee assists the Board in designing, implementing and monitoring the Group's risk management and internal control systems. Through the Audit and Risk Management Committee, the Board is responsible for the continuous review of the effectiveness of the Group's risk management and internal control systems, including financial, operational, compliance, information technology and security, fraud detection and risk management (including ESG risks) controls. Such process includes a self-assessment from the head of each business or supporting unit and internal audit reviews conducted by the Group Internal Audit Department. For the year under review, the Board considers the risk management (including ESG risks) and internal control systems of the Group to be adequate and effective and the Company has complied with the risk management and internal control code provisions set out in the CG Code. Further information about the Group's risk management and internal control framework and process are set out in the "Audit and Risk Management Committee Report" on pages 97 to 109 of this annual report.

Inside Information Policy

The Company adopted a policy and procedure on disclosure of inside information (the "Inside Information Policy") setting out the Group's procedure in handling such information to ensure its equal and timely dissemination to comply with the requirements under Part XIVA of the Securities and Futures Ordinance and the Listing Rules. The Executive Committee was delegated by the Board to monitor the Inside Information Policy and assess the nature and materiality of relevant information and determine appropriate actions. An Inside Information Taskforce has also been set up to assist the Executive Committee on disclosure matters. The Group will provide appropriate training to officers and employees likely to be in possession of inside information.

Auditor's Remuneration

For the year ended 31 December 2023, the fees paid/payable by the Group to PricewaterhouseCoopers ("PwC") for their audit and non-audit services amounted to approximately HK$12.7 million and HK$3.3 million respectively, while the audit and non-audit fees paid/payable by the Group to other auditors were HK$0.4 million and HK$0.2 million respectively. The non-audit services mainly included interim review, taxation, due diligence and other services.

Accountability and Audit

For each financial year, the Directors acknowledge their responsibility for preparing the financial statements which give a true and fair view of the state of affairs, profit and cash flow of the Company and the Group in accordance with Hong Kong Financial Reporting Standards, the Hong Kong Companies Ordinance and the Listing Rules. In preparing financial statements for the year ended 31 December 2023, the Directors have selected suitable accounting policies and applied them consistently. The Directors also made judgements and estimates that are prudent and reasonable and prepared the financial statements on a going concern basis. The Company announced its interim and annual results in a timely manner following the relevant periods as required by the Listing Rules.

The statement from the Company's external auditor about the auditor's responsibilities for the audit of the Company's financial statements is set out in the "Independent Auditor's Report" in this annual report.

Proactive Investor Relations

The Company aims to maintain an ongoing dialogue and communication with its Shareholders. It is the Board's responsibility to ensure that satisfactory dialogue takes place. The Board adopted a shareholders' communication policy (the "Shareholders' Communication Policy") setting out the Company's principles in relation to Shareholders' communication, with the objective to ensure direct, open and timely communications. The primary channel between the Company and Shareholders is the publication of interim reports, annual reports, circulars and notices to Shareholders. The Company's share registrar, Computershare Hong Kong Investor Services Limited (the "Share Registrar"), serves Shareholders on all share registration matters. General meetings further provide the forum and opportunity for Shareholders to exchange views directly with Board members. The Executive Committee recently reviewed the implementation and effectiveness of the Shareholders' Communication Policy and considered that the Shareholders' Communication Policy is effective.

The Company continues its proactive policy to promote investor relations by regular meetings with institutional investors and research analysts. Our Investor Relations Department maintains open communications with the investment community. To ensure investors have an informed understanding of the Company's strategies, operations and management, our management engages in proactive investor relation activities. These include participating in regular one-on-one meetings, post-results analyst briefings, investor conferences and international non-deal roadshows. Our Investor Relations Department also actively provides the investment community with the Company's latest news and developments as they arise through other channels such as IR Newsletters. The Company garnered the IR Magazine Awards – Greater China 2023 in the "Best Crisis Management" category for the Investor Relations Department's proactive engagement with the investment community.

The Company maintains a corporate website (www.shuntakgroup.com) which provides Shareholders, investors and the public with updated information on the Group's activities and development. The Corporate Presentation which includes an overview of the Group's businesses and latest financial results is also available on the corporate website. Corporate information on the Group's businesses, statutory announcements and notices are distributed by emails to the registered mailing list which can be joined by interested parties on the Company's website. The Company Secretary and the Investor Relations Department serve as the major channels of communication between Directors, Shareholders, investors and the public. The public is encouraged to contact the Group as appropriate.

Shareholders may at any time send their enquiries to the Board, addressed to the Company Secretarial Department or Investor Relations Department with contact details set out below:

| Registered Office: | Penthouse 39th Floor, West Tower, Shun Tak Centre 200 Connaught Road Central Hong Kong |

|---|---|

| Telephone: | (852) 2859 3111 |

| Facsimile: | (852) 2857 7181 |

| E-mail: | enquiry@shuntakgroup.com ir@shuntakgroup.com |

In relation to enquiries on the shareholding matters of the Company, Shareholders could send enquiries to the Share Registrar with their contact details set out below:

| Address: | Shops 1712-1716, 17th Floor, Hopewell Centre 183 Queen's Road East Wanchai, Hong Kong |

|---|---|

| Telephone: | (852) 2862 8555 |

| Facsimile: | (852) 2865 0990 |

| E-mail: | hkinfo@computershare.com.hk |

DETAILS OF SHAREHOLDERS

Shareholding of the Company

Shareholding distribution based on the Company’s register of members as at 31 December 2023 is shown below:

| Size of Registered Shareholding | Number of Shareholders | Percentage of Shareholders | Number of shares held | Percentage of shares in issue |

|---|---|---|---|---|

| 1 to 2,000 | 949 | 59.76% | 395,463 | 0.01% |

| 2,001 to 10,000 | 270 | 17.00% | 1,423,830 | 0.05% |

| 10,001 to 100,000 | 311 | 19.59% | 9,347,460 | 0.31% |

| 100,001 to 500,000 | 38 | 2.39% | 7,418,501 | 0.25% |

| 500,001 or above | 20 | 1.26% | 2,999,076,531 | 99.38% |

| Total |

1,588 (Note 2) |

100.00% |

3,017,661,785 (Note 1) |

100.00% |

| Notes: |

|

|---|

Details of the Shareholders' Meetings

The last Shareholders' meeting was the Company's 2023 AGM held at Artyzen Club, 401A, 4th Floor, Shun Tak Centre, 200 Connaught Road Central, Hong Kong on Wednesday, 14 June 2023 at 10:30 a.m.. The notice for the 2023 AGM setting out details of each proposed resolution and other relevant information in the circulars were distributed to all Shareholders more than 21 days before the 2023 AGM. Separate resolutions were proposed on each substantially separate issue, including re-election of individual Directors. In strict compliance with Rule 13.39(4) of the Listing Rules, the Company's Articles stated that all resolutions proposed in a general meeting will be decided on poll except for procedural or administrative matters. The Share Registrar was appointed as the scrutineer for vote-taking at the 2023 AGM. Procedures for conducting a poll were explained by the Share Registrar before commencement of poll voting at the 2023 AGM.

All resolutions at the 2023 AGM were duly passed including (i) receipt of the audited financial statements of the Company for the year ended 31 December 2022 and the reports of Directors and the independent auditor; (ii) re-election of Ms. Pansy Ho and Mr. Norman Ho as Directors of the Company; (iii) approval of the Directors' fees; (iv) re-appointment of PwC as auditor of the Company and authorisation to the Board to fix its remuneration; (v) granting of the general mandate to the Board to buy back the Company's shares; (vi) granting of the general mandate to the Board to issue new shares of the Company; and (vii) authorisation to the Board to extend the general mandate to issue new shares by adding the number of shares bought back.

The poll results were posted on the websites of the Company and the Stock Exchange in accordance with the Listing Rules as soon as after the closure of the 2023 AGM.

The 2024 AGM will be held on Wednesday, 5 June 2024 at 4:00 p.m. at Artyzen Club, 401A, 4th Floor, Shun Tak Centre, 200 Connaught Road Central, Hong Kong. The notice of the 2024 AGM, which constitutes part of a circular to Shareholders, will be sent together with this annual report.

Important Shareholders' Dates

Important Shareholders' dates in the financial year 2024 are set out in "Financial Highlights and Calendar" in this annual report.

Dividend Information

The Company's dividend policy is set out in "Report of the Directors" in this annual report. Dividend payment history is available on the Company's website.

Shareholders' Rights

Procedures for Shareholders to Convene a General Meeting

In accordance with Section 566 of the Hong Kong Companies Ordinance (Chapter 622) (the "Ordinance"), Shareholders representing at least 5% of the total voting rights of all Shareholders having a right to vote at general meetings can make a requisition to convene a general meeting. The requisition must state the objects of the meeting, and be signed by the Shareholders concerned and deposited at the registered office of the Company for the attention of the Company Secretary. The requisition must also (a) state the name(s) of the requisitionist(s), (b) the contact details of the requisitionist(s) and (c) the number of ordinary shares of the Company held by the requisitionist(s).

Procedures for Shareholders to Put Forward Proposals at General Meeting

According to the Ordinance, Shareholder(s) representing at least 2.5% of the total voting rights of all Shareholders who have a relevant right to vote; or at least 50 Shareholders who have a relevant right to vote can submit a written request to move a resolution at the general meeting of the Company. The written request must state the resolution, accompanied by a statement of not more than 1,000 words with respect to the matter referred to in the proposed resolution, signed by the relevant Shareholder(s) and deposited at the registered office of the Company.

COMPANY SECRETARY

The Company Secretary is a full-time employee of the Company and has day-to-day knowledge of the Company's affairs. The Company Secretary is responsible for advising the Board on governance matters. For the year under review, the Company Secretary has taken no less than 15 hours of relevant professional training.

OTHERS

Constitutional Documents

During the year ended 31 December 2023, no amendment was made to the Company's Articles. The latest version of the Articles is available on the websites of the Company and the Stock Exchange.

Looking Forward

The Company will continue to review its corporate governance practices on a timely basis and take necessary and appropriate actions to ensure compliance with the required practices and standards including code provisions in the CG Code.

Remuneration Committee Report(Extracted from 2023 Annual Report dated 26 March 2024)

COMPOSITION

The Remuneration Committee consists of six members, namely, Mr. Norman Ho, Mr. Charles Ho, Mr. Michael Wu and Mr. Kevin Yip (all being INEDs), Ms. Pansy Ho (Group Executive Chairman and Managing Director) and Ms. Daisy Ho (Executive Director and Deputy Managing Director). Mr. Michael Wu is the chairman of the Remuneration Committee.

DUTIES AND RESPONSIBILITIES

The principal role of the Remuneration Committee is to set the Company's remuneration and incentive policy as a whole, and review and approve remuneration proposals for Executive Directors and senior management. The emoluments of the Directors, including basic salary and performance bonus, are based on each Director's skills, knowledge and involvement in the Company's affairs, the Company's performance and profitability, remuneration benchmark in the industry and prevailing market conditions. No Director has taken part in setting his or her own remuneration.

According to its terms of reference (a copy of which is posted on the websites of the Company and the Stock Exchange), the Remuneration Committee shall meet at least once a year. Additional meetings may be held as required. Decisions may also be made by circulation of written resolutions accompanied by explanatory materials.

ANNUAL WORK SUMMARY

During the year ended 31 December 2023, a Remuneration Committee meeting was held. The Remuneration Committee reviewed, made recommendation on INEDs' remuneration packages to the Board, approved the remuneration packages for Executive Directors, senior management and staff, and approved the Remuneration Committee Report as incorporated in the 2022 Annual Report.

REMUNERATION POLICY

The remuneration policy of the Company (the "Remuneration Policy") establishes a formal and transparent procedure for determining remuneration of Directors and senior management. To achieve the Company's corporate goals and objectives, packages offered by the Group are competitive, adequate (but not excessive), in line with current market practices and able to attract, retain, motivate and reward Directors and senior management. To ensure that the Remuneration Policy is effective, the Remuneration Committee will review the policy and recommend revisions to the Board when necessary. The Remuneration Policy was updated in December 2017.

Directors' interests in the Company's shares, underlying shares and debentures, along with interests in contracts, are set out in "Report of the Directors". Particulars regarding Directors' emoluments and the five highest paid individuals are set out in "Notes to the Financial Statements" in this annual report.

Nomination Committee Report(Extracted from 2023 Annual Report dated 26 March 2024)

COMPOSITION

The Nomination Committee consists of six members, namely, Mr. Norman Ho, Mr. Charles Ho, Mr. Michael Wu and Mr. Kevin Yip (all being INEDs), Ms. Pansy Ho (Group Executive Chairman and Managing Director) and Ms. Daisy Ho (Executive Director and Deputy Managing Director). Ms. Pansy Ho is the chairman of the Nomination Committee.

DUTIES AND RESPONSIBILITIES

The Nomination Committee is responsible for (i) formulating policy and making recommendations to the Board on nomination and appointment of Directors and the Board's succession planning; and (ii) monitoring the implementation of the Board Diversity Policy and nomination policy (the "Nomination Policy") and reviewing the same and recommending any revisions to the Board for consideration. The Nomination Committee develops selection procedures for candidates and will consider different criteria including relevant professional knowledge, industry experience, and the standards set forth in Rules 3.08 and 3.09 of the Listing Rules. It reviews the structure, size and composition of the Board annually to ensure that it has balanced skills and expertise to provide effective leadership to the Company. It assesses the independence of INEDs under the criteria in Rule 3.13 of the Listing Rules.

According to its terms of reference (a copy of which is posted on the websites of the Company and the Stock Exchange), the Nomination Committee shall meet as required by its work. Decision may also be made by circulation of written resolutions accompanied by explanatory materials.

ANNUAL WORK SUMMARY

During the year ended 31 December 2023, a Nomination Committee meeting was held to review the structure, size, composition and diversity of the Board; the Directors' involvement in the Company's affairs; the implementation and effectiveness of the Board Diversity Policy and Nomination Policy; and the independence of INEDs; and make recommendations to the Board for putting forward Directors, who were subject to retirement by rotation, for re-appointment at 2023 AGM; and approve the Nomination Committee Report as incorporated in the 2022 Annual Report.

NOMINATION POLICY

In December 2018, the Company adopted the Nomination Policy which sets out the nomination procedures and the process and criteria to select and recommend candidates for directorship. The Nomination Committee would select the candidates based on the objective criteria, including without limitation, educational background, professional experience, skills, knowledge, personal qualities and the benefit of diversity as set out under the Board Diversity Policy. The Nomination Committee would also take into account whether the candidate can demonstrate his/her commitment, competence and integrity required for the position, and in case of INEDs, the independence requirements under the Listing Rules and their time commitment to the Company. The Nomination Committee monitors the implementation of the Nomination Policy and will review and recommend any revisions to the Board for consideration and approval, when necessary, to enhance effectiveness. The Nomination Policy was updated in March 2022.

Audit and Risk Management Committee Report(Extracted from 2023 Annual Report dated 26 March 2024)

COMPOSITION

The Audit and Risk Management Committee consists of three members, namely, Mr. Norman Ho, Mr. Michael Wu and Mr. Kevin Yip, all being INEDs. Mr. Norman Ho is the chairman of the Audit and Risk Management Committee. The Board is satisfied that the Audit and Risk Management Committee members collectively possess adequate financial experience to properly perform its duties and responsibilities. Mr. Norman Ho and Mr. Michael Wu hold professional accounting qualifications required by Rule 3.10(2) of the Listing Rules, details of which are set out in their biographies in "Management Profile" in this annual report.

DUTIES AND RESPONSIBILITIES

The Audit and Risk Management Committee's primary responsibilities include reviewing the Company's financial reports, risk management and internal control systems (including, among others, risks relating to ESG), and effectiveness and objectivity of the audit process.

According to its terms of reference (a copy of which is posted on the websites of the Company and the Stock Exchange), the Audit and Risk Management Committee shall meet at least twice a year. Decisions may be made by circulating written resolutions accompanied by explanatory materials.

ANNUAL WORK SUMMARY

During the year ended 31 December 2023, two Audit and Risk Management Committee meetings were held to review, inter alia, (i) the Company's interim and year-end financial reports, particularly areas requiring judgement, before submission to the Board; (ii) the internal audit programme and the effectiveness of the internal audit function (including audit progress, findings and management's responses); (iii) the adequacy and effectiveness of the risk management and internal control systems (including the risk management processes, the principal risks identified and risk mitigation controls); (iv) PwC's confirmation of independence, its reports for the Audit and Risk Management Committee and management's letter of representation; (v) the fees for annual audit and non-audit services for the year ended 31 December 2022 and recommendations regarding re-appointment of the Company's external auditor; and (vi) the adequacy of resources, qualifications, experiences and training requirements of staff responsible for accounting, financial reporting, treasury, financial analysis, ESG and internal audit functions and approved the Audit and Risk Management Committee Report as incorporated in the 2022 Annual Report.

The Audit and Risk Management Committee also reviewed continuing connected transactions; reviewed and approved PwC's terms of engagement as the Company's external auditor for the year ended 31 December 2023, and its further engagement to (a) review the Company's preliminary results announcement for the year ended 31 December 2023; and (b) report on continuing connected transactions as disclosed in this annual report. As at the date of this report, the Audit and Risk Management Committee also approved the fees for annual audit and non-audit services for year ended 31 December 2023, and recommended the re-appointment of PwC (the retiring auditor at the forthcoming AGM) as the Company's external auditor.

With the introduction of the Group's whistleblowing policy (the "Whistleblowing Policy") since December 2011 and its updates in August 2017 and March 2022, employees and those who deal with the Group (e.g. customers and suppliers) are provided with a channel and guideline to report suspected misconduct, malpractice or irregularity within the Group without fear of reprisal or victimization. The Audit and Risk Management Committee was delegated with the overall responsibility for monitoring and reviewing the effectiveness of the Whistleblowing Policy.

To promote and support anti-corruption laws and regulations, the Group has set up systems and internal procedures for prevention of bribery, fraud and corruption. Details of the procedures are set out in the Group's code of conduct and communicated across all business units and relevant trainings are provided to employees. Regular seminars, including presentations by the Hong Kong Independent Commission Against Corruption, are organised for new and existing employees.

RISK MANAGEMENT AND INTERNAL CONTROL

Responsibilities of the Board and Management

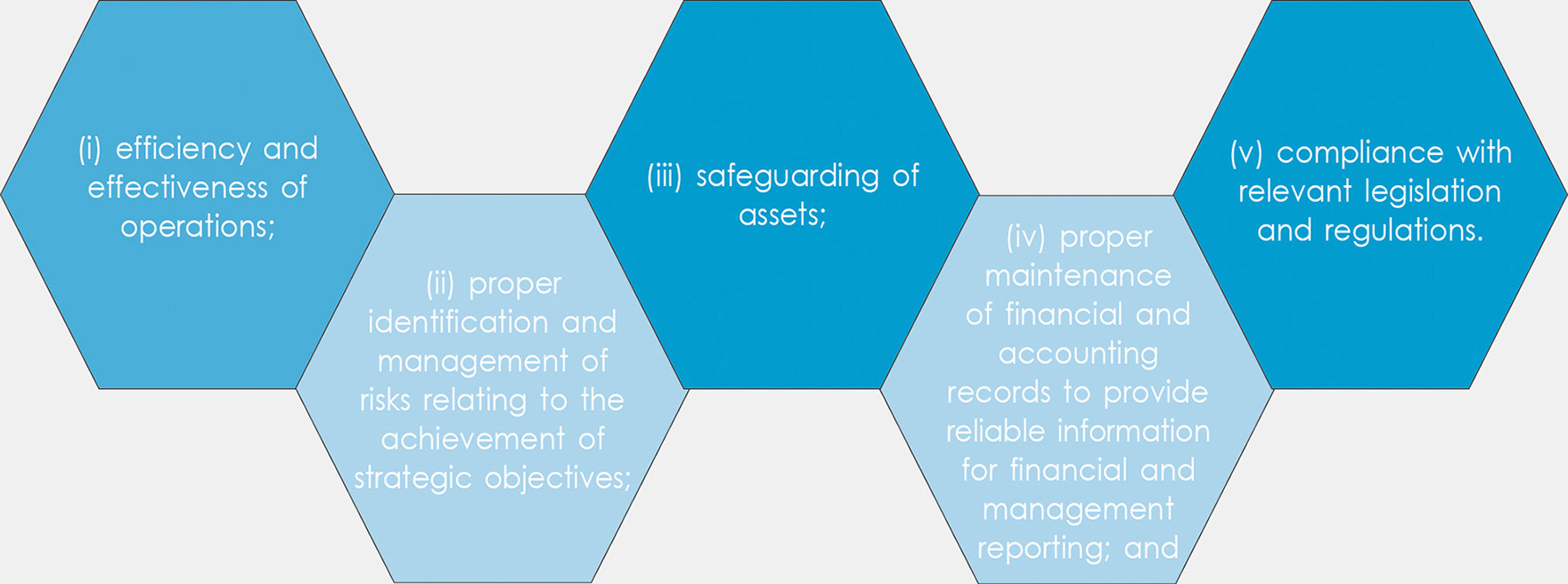

Shun Tak Group's risk management (including, among others, risks relating to ESG) and internal control responsibilities reside at all levels within the Group, from the Board down to heads of business and supporting units as well as the general staff. The Board has overall responsibility for ensuring that appropriate and effective risk management and internal control systems (including, among others, risks relating to ESG) are established and maintained. The Executive Committee assists the Board in designing, implementing and monitoring the Group's risk management and internal control systems (including, among others, risks relating to ESG) which have been designed to ensure:

Such systems are aimed at mitigating risks faced by the Group to an acceptable level, but not eliminating all risks. Hence, such systems can only provide reasonable, but not absolute, assurance that there will not be any material misstatement in the financial information and any financial loss or fraud.

Main features of the risk management and internal control systems

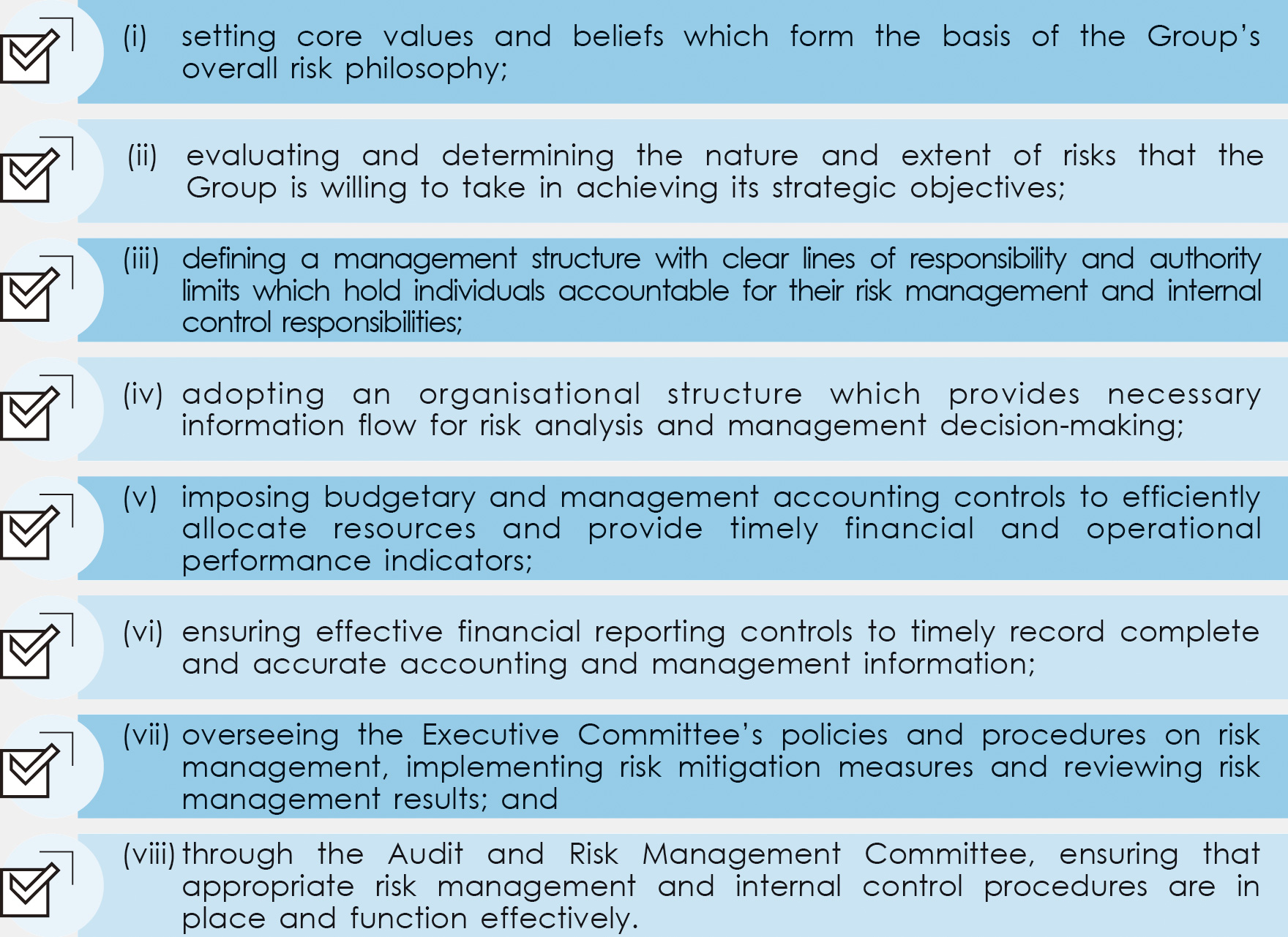

The Board has established a framework to maintain appropriate and effective risk management and internal control systems (including, among others, risks relating to ESG), which includes the following key procedures:

Ongoing and annual review

Through the Audit and Risk Management Committee, the Board continues to review the effectiveness of the Group's risk management and internal control systems, including financial, operational, compliance, information technology and security, fraud detection and risk management (including, among others, risks relating to ESG) controls. Such process encompasses a self-assessment from the head of each business or supporting unit and internal audit reviews conducted by the Group Internal Audit Department ("GIAD").

Control self-assessment from the Head of each Business or Supporting Unit

On an annual basis, the head of each business or supporting unit signs a confirmation to the Board that he/she has self-assessed the risk management and internal control systems (including, among others, risks relating to ESG) of their operations against the criteria for effective internal control and risk management in the Internal Control – Integrated Framework issued by the Committee of Sponsoring Organisations of the Treadway Commission (the "COSO Framework") and confirms that such systems are operating effectively.

The Executive Committee also conducts an annual review of the Group's risk management and internal control systems (including, among others, risks relating to ESG) with reference to the criteria in the COSO Framework and confirms to the Board that they are adequate and are operating effectively.

Internal audit reviews conducted by GIAD

The GIAD reports to the Audit and Risk Management Committee and has unrestricted access to the Group's records and personnel. To ensure systematic coverage of all auditable areas and effective deployment of resources, a four-year strategic audit plan adopting a risk ranking methodology has been formulated. This plan is revised annually to reflect organisational changes and new business development and is submitted for the Audit and Risk Management Committee's approval. Ad-hoc reviews will also be conducted if areas of concern are identified by the Audit and Risk Management Committee and management.

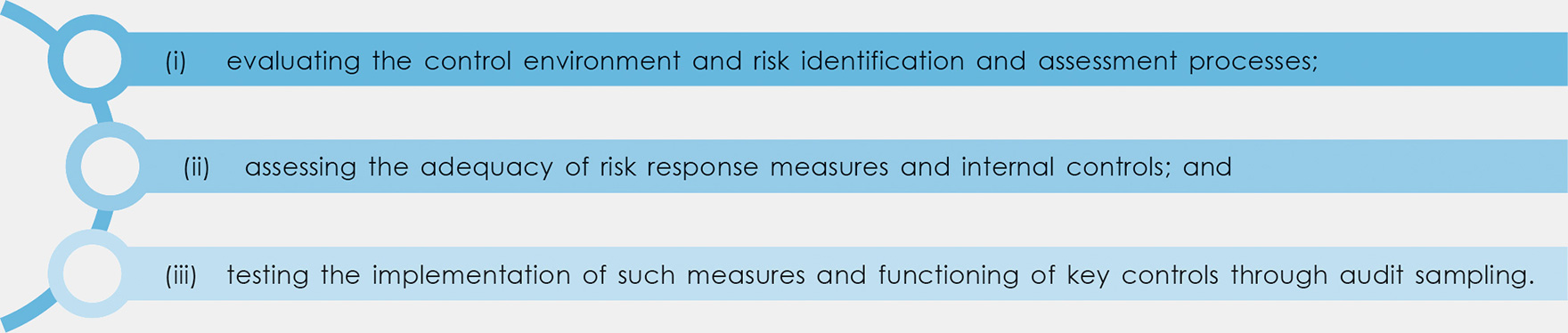

The GIAD reviews risk management and internal controls by:

The GIAD also assists the Audit and Risk Management Committee in its reviews of the adequacy of resources, qualifications, experiences and training requirements of staff responsible for accounting, financial reporting, treasury, financial analysis, ESG and internal audit functions. During each audit, staff qualifications and experience as well as manpower plans and training budgets are also reviewed to ensure competent staff are in place to maintain effective risk management and internal control systems. An audit report incorporating control deficiencies findings and management's rectification plans is issued for each audit.

The GIAD reports quarterly to the Audit and Risk Management Committee on the results of its assessment of the risk management and internal control systems (including, among others, risks relating to ESG) and status of implementation of follow-up actions on control deficiencies. In addition, the head of the GIAD attends Audit and Risk Management Committee meetings twice a year to report its progress.

The process used to identify, evaluate and manage risks (including, among others, risks relating to ESG)

Risk management is integrated into the Group's culture and day-to-day activities. With reference to International Standard on Risk Management-Principles and Guidelines ("ISO31000"), policies and procedures on risk management have been established to ensure a consistent approach to identify and address risks (including, among others, risks relating to ESG) in business processes. The Board has established a well-defined Risk Appetite to guide employees on the level of risk permitted. Each unit maintains a risk register to record all identified risks (including any emerging risks) by taking into account various external and internal factors including economic, financial, political, technological, ESG, health and safety, legislation and regulations, operational, processing and execution as well as the Group's strategies and objectives and stakeholders' expectations. A formal assessment is conducted to rank each of the identified risk. The risk ratings are determined based on the likelihood of a risk occurring and its potential impact or consequences.

Risk treatment options and mitigation controls are identified, analysed, implemented and reviewed. Risk management results are reported to the Executive Committee and the Audit and Risk Management Committee twice a year.

RISK MANAGEMENT PROCESS

PRINCIPAL RISK FACTORS

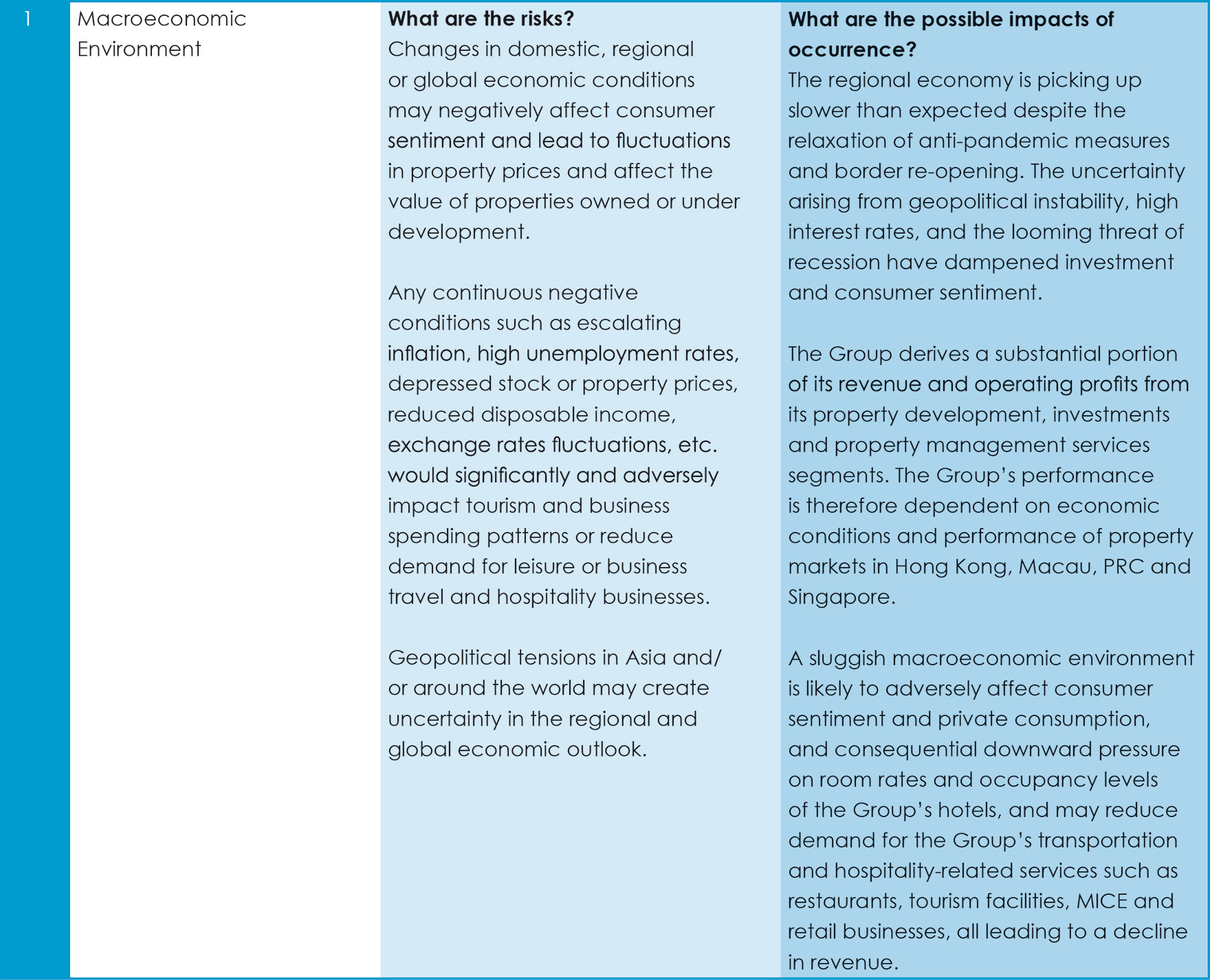

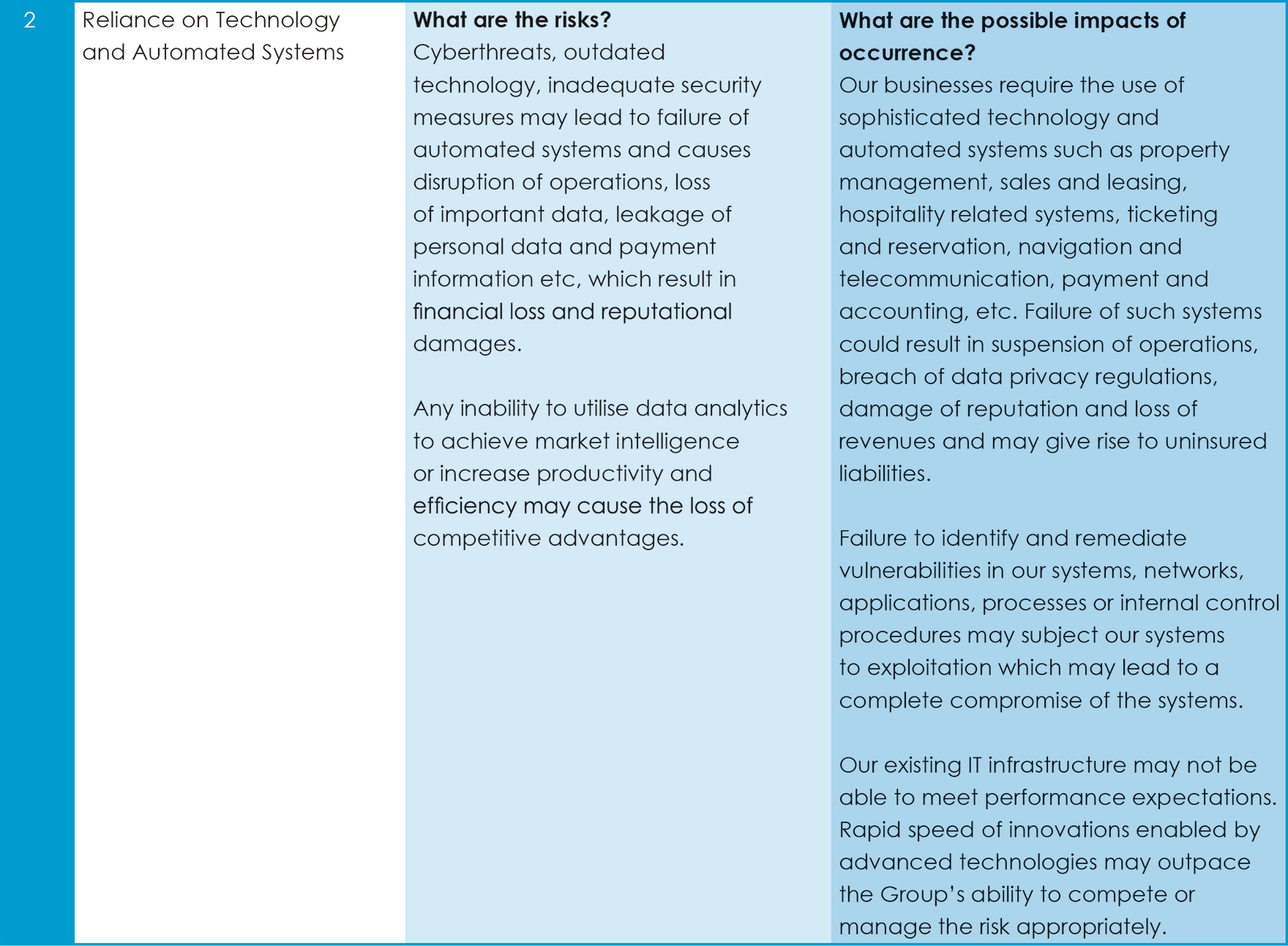

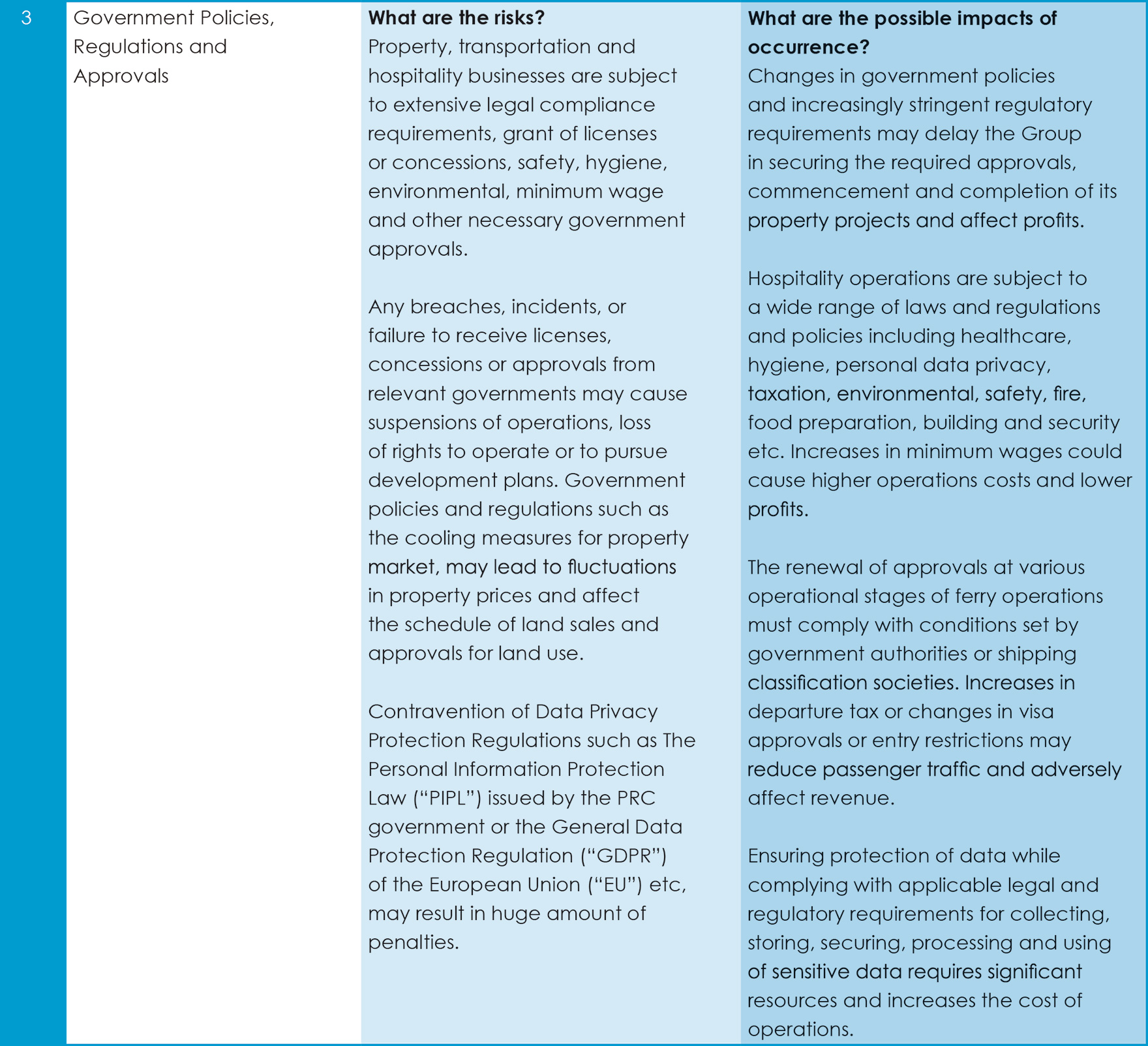

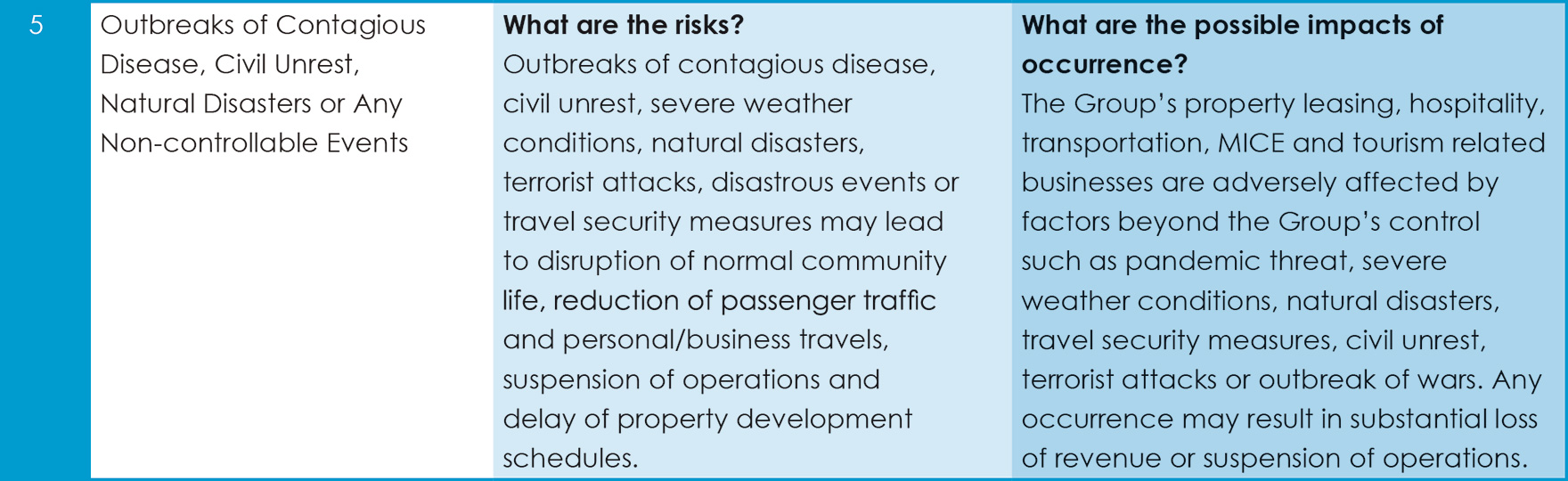

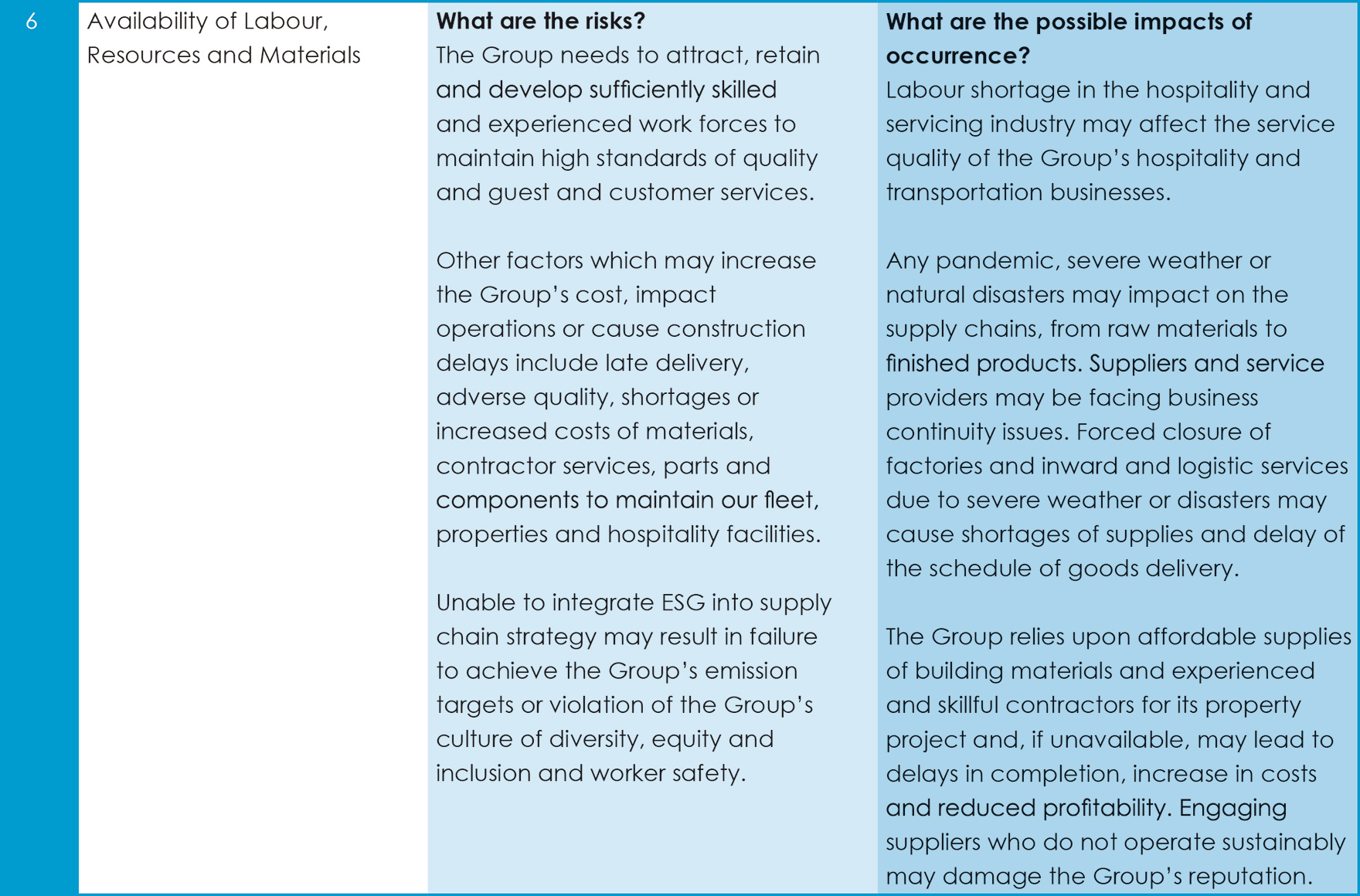

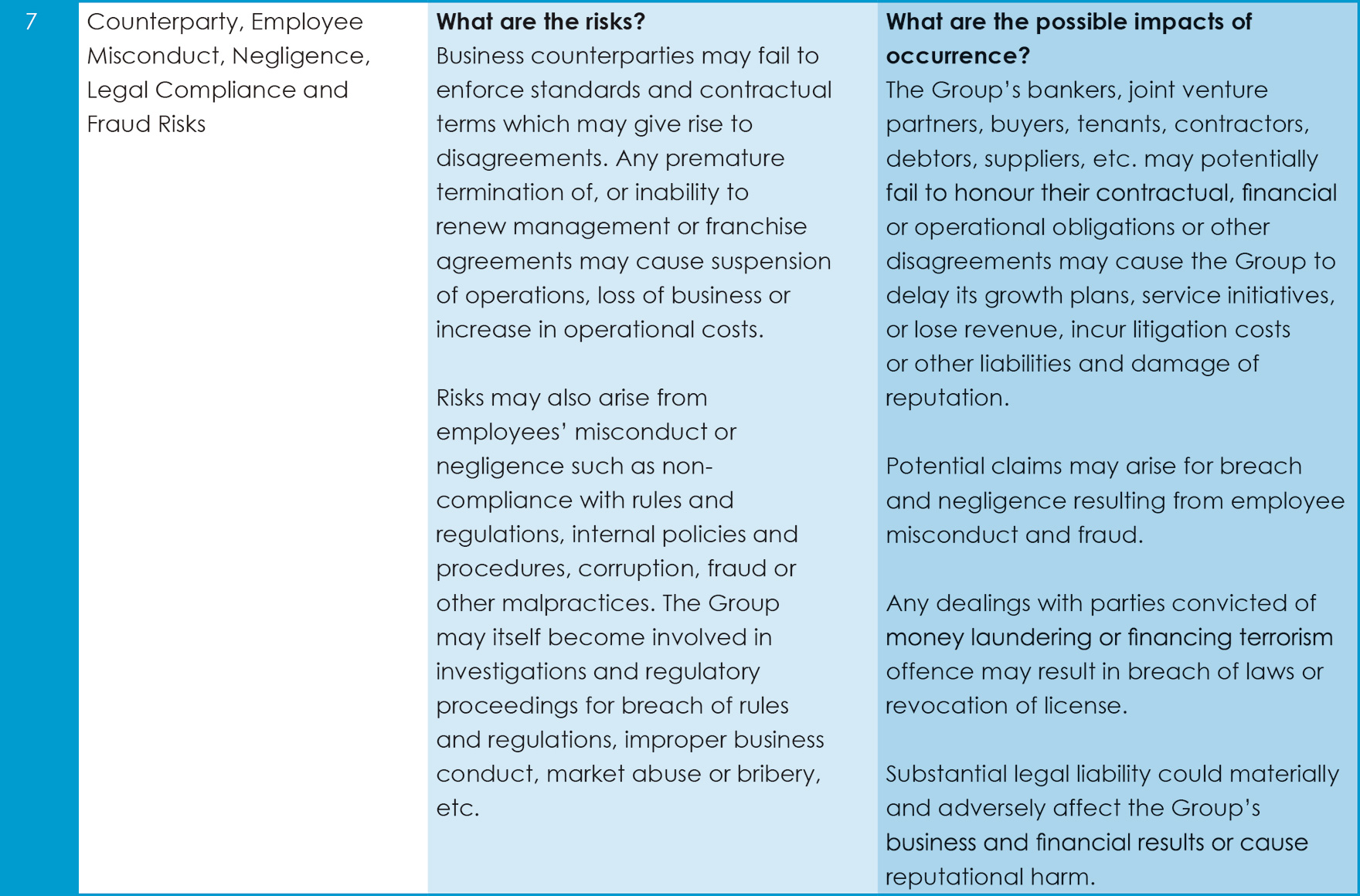

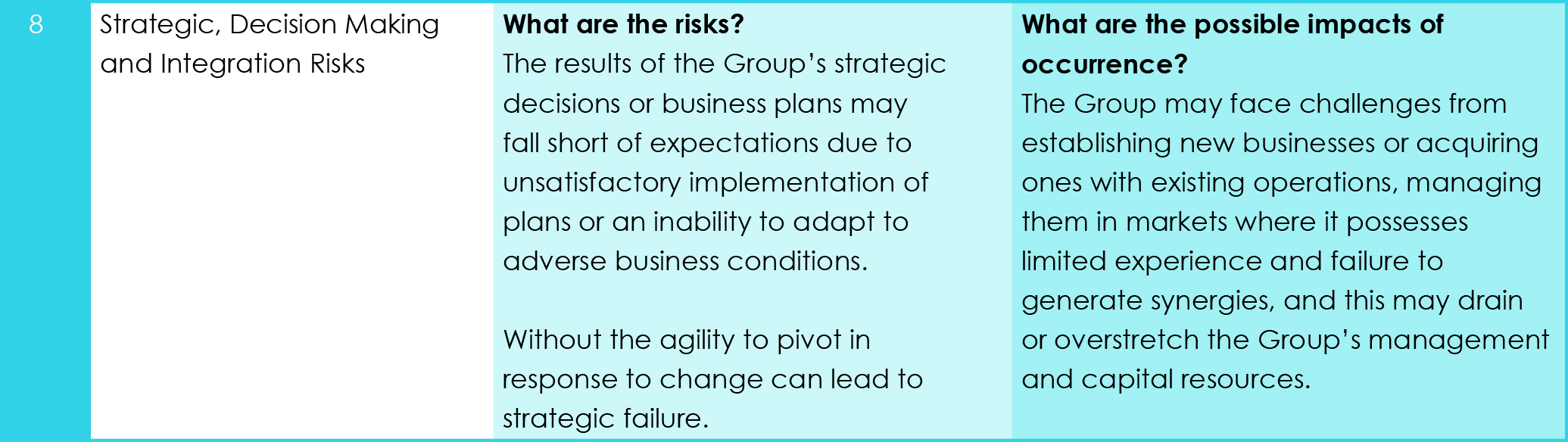

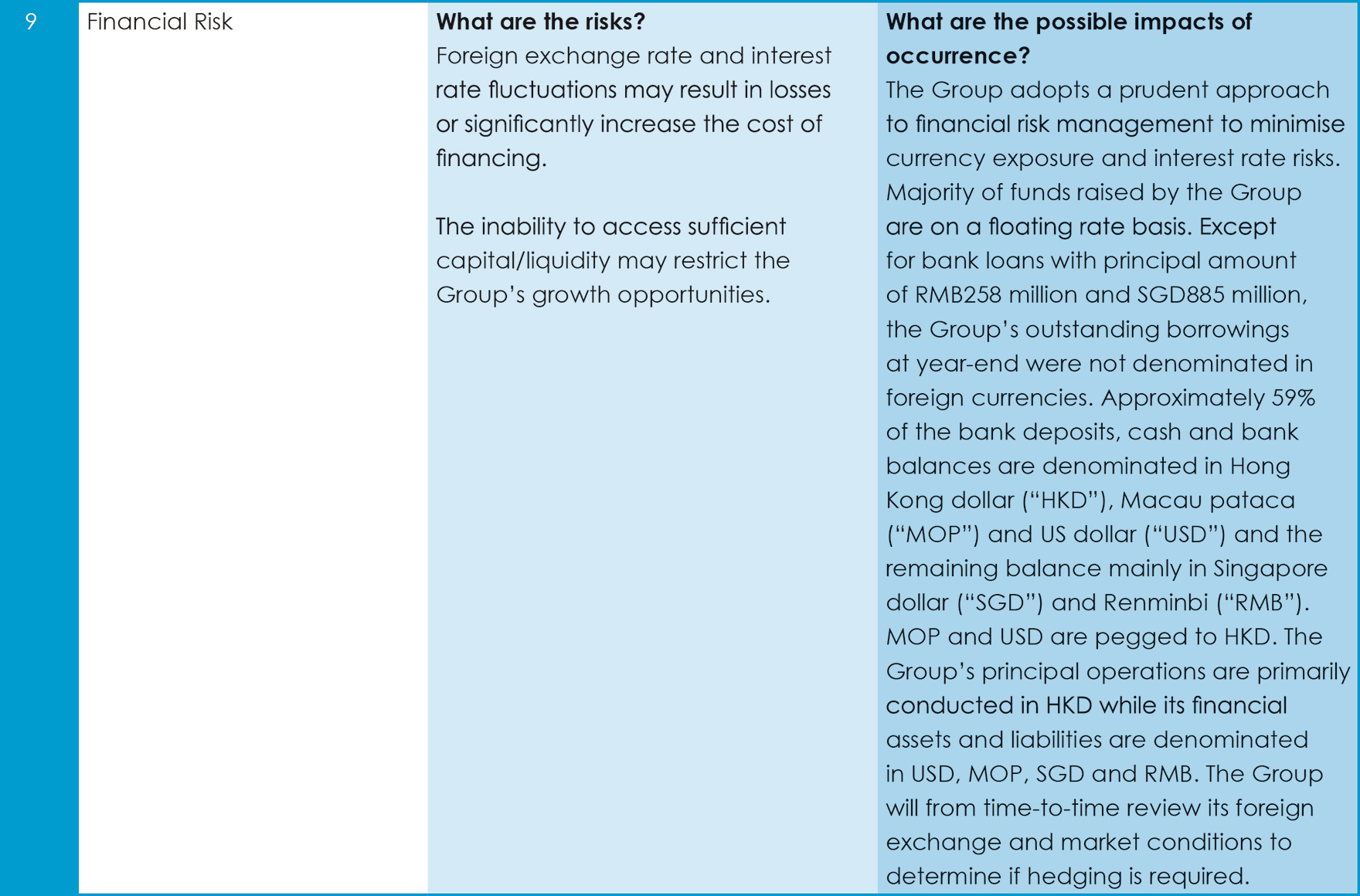

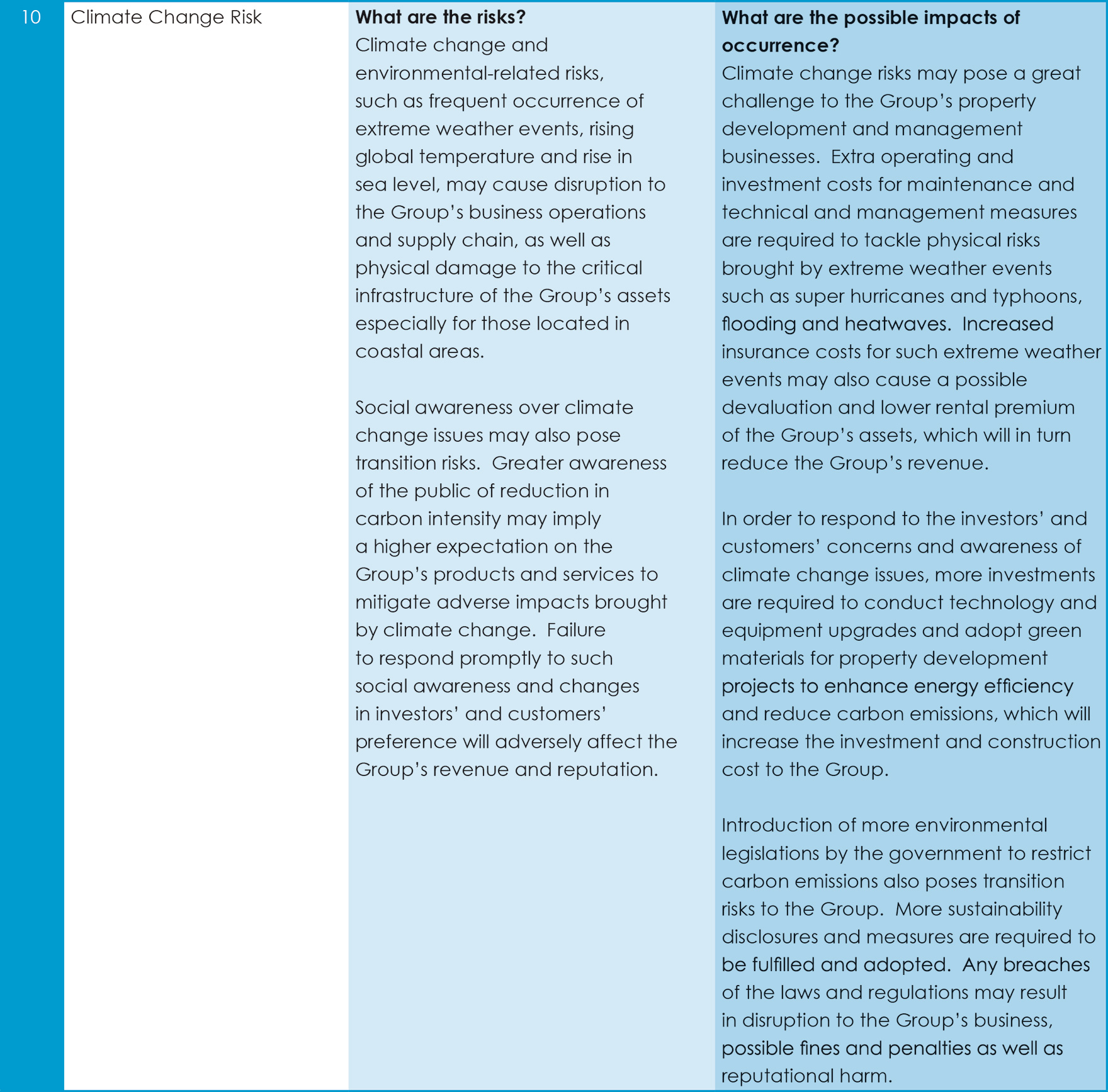

The Group's financial performance, operations and prospects for growth may be affected by risks and uncertainties, both direct and indirect. Based on the Group's risk assessment procedures, key risk factors are identified and are set out below (For details of the ESG risks, please refer to the Group's sustainability report which was separately issued in April 2024) but they are not exhaustive or comprehensive and there may be additional risks not yet known to the Group or known risks whose significance will appear only in the future:

RISK MITIGATION MEASURES

The Group's risk management and internal control systems ensure the proper identification, management and mitigation of risks (including, among others, risks relating to ESG). The Executive Committee, together with a panel of senior management and working groups who are experienced in business development, fuel hedging, crisis management, safety, health and environmental protection, business continuity and information technology, closely monitor potential risks to minimise their impact (if any) on the Group; and explore ways to develop and enhance services and products, reduce cost and generate income for the Group.

Subject to the provisions under the Companies Ordinance (Cap. 622), the Rules Governing The Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and the Articles of Association of the Company (the “Articles”), shareholders of the Company shall have rights to propose a person for election as a director of the Company (the “Election”) at an annual general meeting (“AGM”), provided that the total number of directors shall not exceed the maximum number fixed by or in accordance with the Articles.

Shareholder who wishes to propose a person other than a retiring director of the Company for election as a director at the AGM should deposit a written notice to that effect at the registered office (address shown below) of the Company for the attention of the Company Secretary.

Penthouse 39th Floor, West Tower, Shun Tak Centre

200 Connaught Road Central, Hong Kong

The written notice signed by the shareholder (not being the person to be proposed) qualified to attend and vote at the AGM should include the following information:

- the full name and address of the person proposed for election;

- personal biographical details of such nominated candidate as required by Rule 13.51(2) of the Listing Rules; and

- a written consent signed by the nominated candidate indicating his/her willingness to be elected as director.

The written notice must be lodged with the Company at its registered office during a 7-day period commencing from the day after the despatch of the notice of AGM appointed for such election (or such other period, being a period of at least 7 days commencing no earlier than the date after the despatch of the notice of AGM and ending no later than 7 days prior to the date of AGM, as may from time to time be determined by the Board and notified to the shareholders). If the written notice is lodged less than 15 business days prior to the date of the AGM, the Company will need to consider the adjournment of the AGM in order to allow shareholders 10 business days notice (or such notice period under the applicable rules and regulations) of the proposal.

Upon receipt of the signed written notice and due verifications on information provided, the Company shall provide information to shareholders regarding the proposal as soon as practicable, without prejudice to any applicable rules and regulations as effective from time to time.

The Group has a Whistleblowing Policy which ensures a mechanism for our employees and those who deal with the Group, to raise their concerns about any suspected misconduct, malpractice or irregularity within the Group. The Board’s Audit and Risk Management Committee has the overall responsibility to monitor the Group’s whistleblowing mechanism. All whistleblowing reports will be handled in the strictest confidence, and the Group will endeavour to protect whistleblowers who made the report in good faith, from any unfair treatment or reprisal, where circumstances warrant.

The scope of the Group’s Whistleblowing Policy includes suspected fraud, breach of law and regulatory requirements, or any malpractice, impropriety or irregularities but it is not designed to handle enquiries or complaints of the Group’s products or services or any questioning of financial or business decision taken by the Group or any staff matters which have been addressed under the Group’s Equal Opportunities Policy. The Group reserves the right to take appropriate actions against any persons who make reports in bad faith.

Whistleblowing report can be made by calling our Whistleblowing Hotline: (852) 2859 4600 or in writing in the standard form and send to the following mailing address or email account:

-

Mailing Address:

Shun Tak Holdings Limited

Unit 1216, 12th Floor, China Merchants Tower,

Shun Tak Centre,

200 Connaught Road Central,

Hong Kong.Attn: Head of Group Internal Audit Department

(Note: All whistleblowing reports by post shall be sent in a sealed envelope clearly marked “Strictly Private and Confidential - To be opened by Addressee only” to ensure confidentiality.) - Email Address: whistleblowing@shuntakgroup.com